Our platform

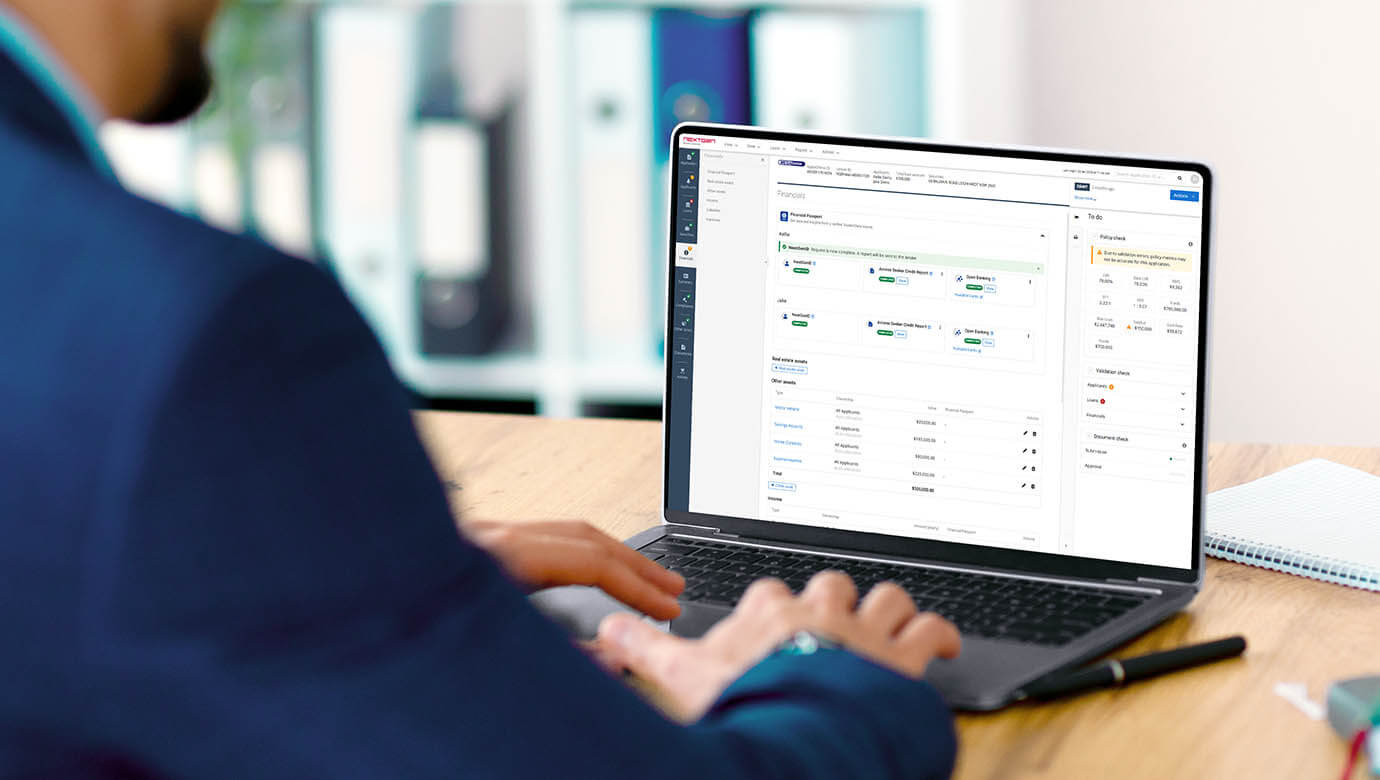

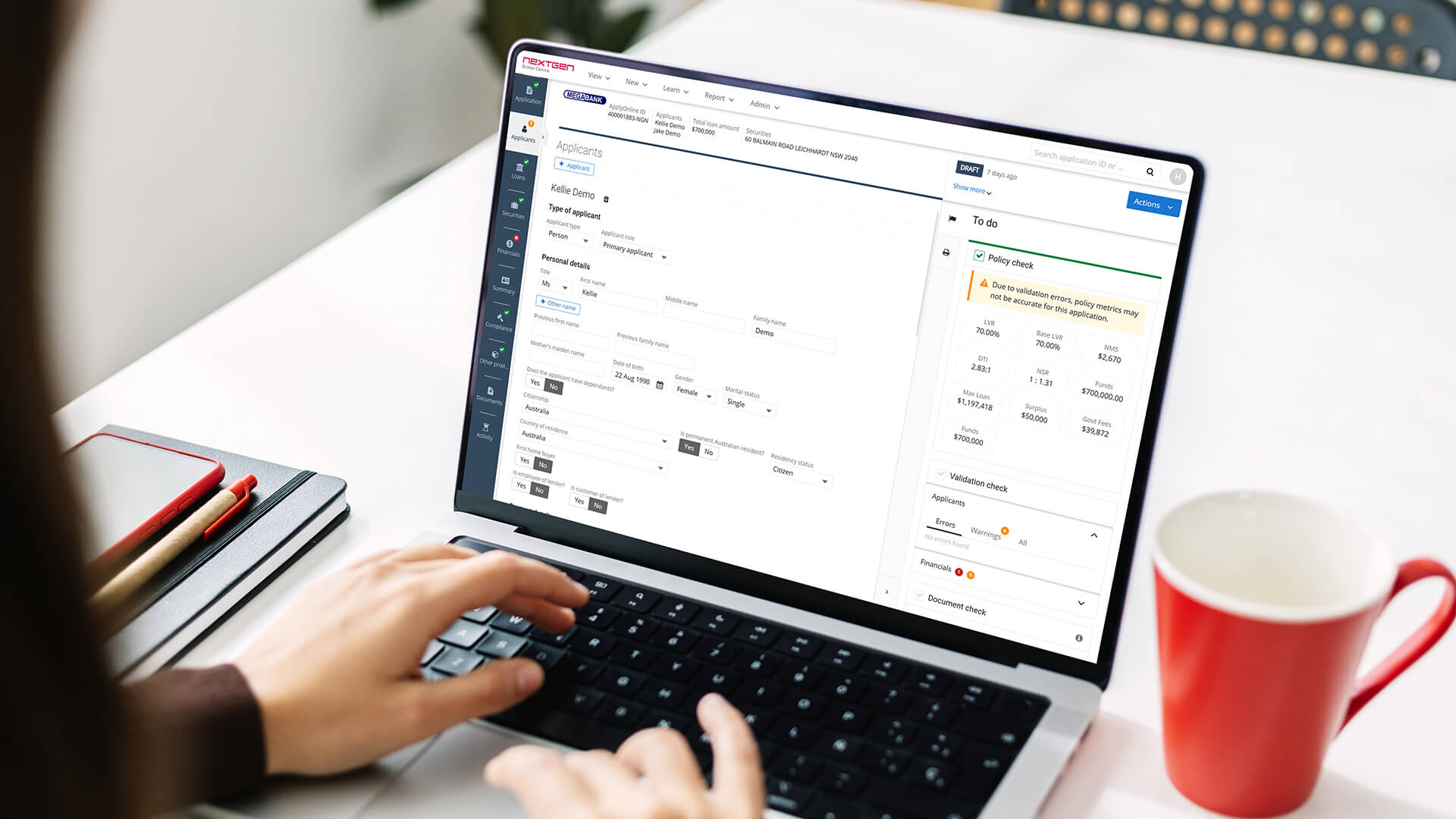

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

In a strategic move to expand their market presence and deepen their relationship with brokers and broker groups, Thinktank has joined forces with NextGen.

Introducing the ApplyOnline® platform has transformed the non-bank lender’s home loan application process, enabling a complete digital experience for brokers and a remarkable improvement in approval times.

Cath Ryan, Thinktank’s Regional Sales Executive for NSW/ACT, emphasised the profound impact of NextGen’s implementation, particularly in reducing turnaround times for brokers:

“We’ve been very, very happy with the implementation of NextGen and ApplyOnline with Thinktank. We just had [some] great broker feedback … This is the first experience that this broker has had with this technology, and they’ve actually achieved a four-hour turnaround with us. That’s the first time in 17 years as a broker that they’ve got that sort of level of turnaround”.

James Henshaw, Thinktank’s Chief Information Officer, echoed this sentiment, describing the project as “groundbreaking” and “one of the most successful I.T. projects” in which they’ve been involved. He emphasised the seamless process and the expanded reach ApplyOnline provided.

“One of the main drivers for us implementing the NextGen system is that it opened us up to another 90 percent of the brokers. So everything so far has been tick, tick, tick.”

Thinktank made the strategic decision to enable a full suite of digital services within ApplyOnline for brokers, including electronic signatures for loan documents, and has mandated the use of NextGenID for remote verification of identity (VOI) and the Access Seeker Credit Report service – all available at no cost to brokers. These services simplify the application process, saving a significant amount of administrative time and effort and empower brokers with the essential tools to evaluate the loan viability up front, reducing reworks and expediting time to approval.

Speaking on the partnership, Mike Ponsonby, NextGen’s Head of Lender Partnerships, highlighted the strategic vision shared by Thinktank and NextGen, emphasising the focus on sustainability, consistency, and digital enablement. “For [Thinktank], it was really important to build a sustainable and consistent model that was very much around digital enablement and … driving a great experience for brokers.”

Thinktank has also enabled SMSF mortgage applications to brokers through ApplyOnline, underscoring their commitment to meeting evolving market demands.

As Thinktank and NextGen continue their journey together, the future looks promising, with opportunities for further growth, efficiency gains, and enhanced customer experiences on the horizon. This partnership exemplifies the power of innovation and collaboration in driving success in today’s competitive market landscape.

Watch the highlights from our celebration event with Thinktank and hear firsthand the impact of our partnership for brokers and customers alike. In this video, catch a glimpse of the event and hear testimonials from key stakeholders.

ApplyOnline tip

Track your application progress in real-time with the Activity timeline

Learn more

Article

What Australian lenders told us about the future of lending

Learn more

ApplyOnline tip

Maximise workspace efficiency with the enhanced ‘policy check’ panel

Learn more

Article

Reverse mortgages now available in ApplyOnline

Learn more

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.