Our platform

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

Improve the speed and accuracy of loan applications with an enhanced customer experience and increased security.

Government-regulated Consumer Data Right (CDR) framework removes the need for manual document collection or screen scraping.

Faster collection using real-time verified data sources enables Fastlane and automated approvals.

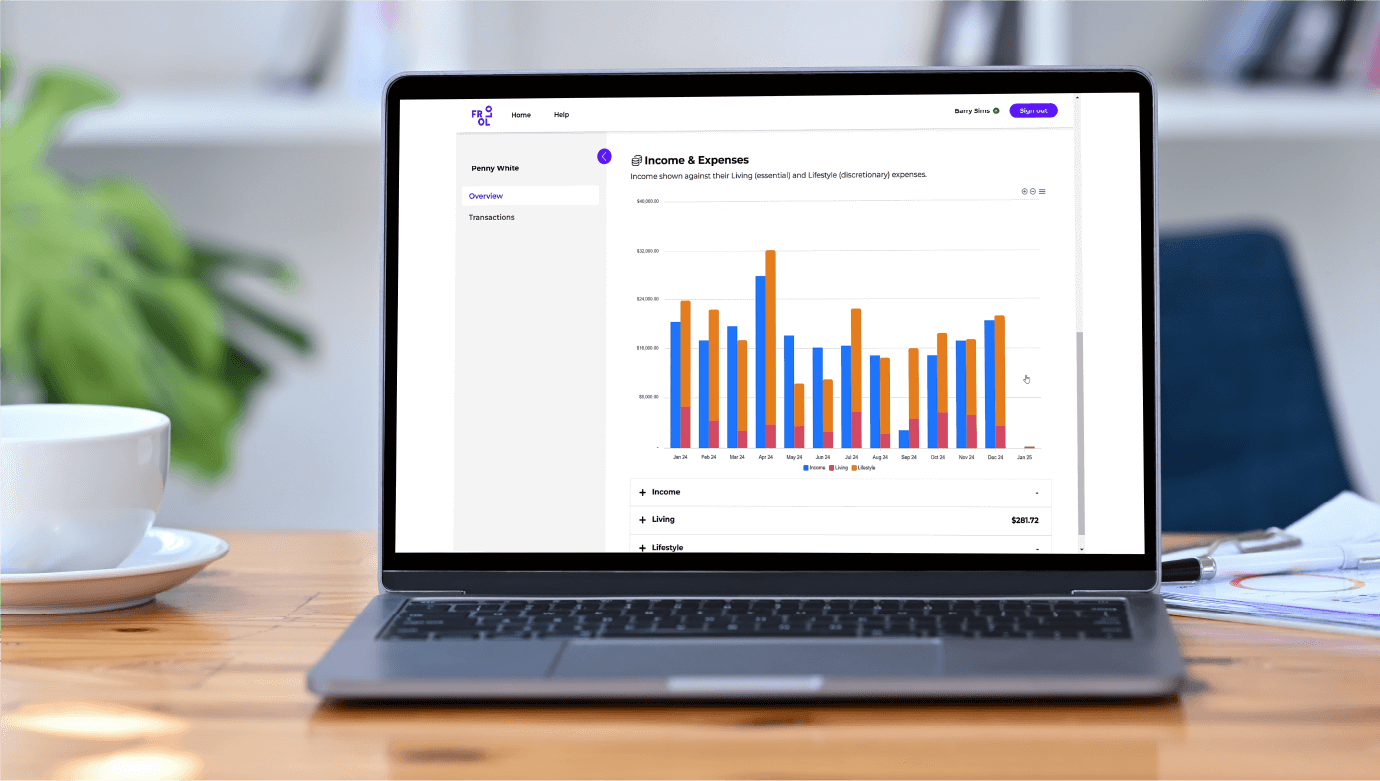

Transaction data categorisation and enhancement using the latest AI technology.

Validate application data upfront including assets, liabilities, and income.

NextGen enables mortgage brokers and lenders to use Open Banking to improve the speed and accuracy of completing and submitting loan applications, delivering a better experience for brokers and customers.

Our Open Banking solution delivers a seamless experience between the customer, broker and Accredited Data Holders (like banks) to securely request and receive customer consent, and then retrieve data. This all happens within a matter of minutes, and more importantly without customers having to share internet banking passwords.

NextGen Open Banking offers brokers a government-regulated and secure way to access rich data and insights. Gaining a more accurate and complete financial picture helps with assessing lending readiness, lender selection and speeds up completion of loan applications in ApplyOnline®.

Integrated with aggregator CRMs for upfront assessment with data connection to ApplyOnline.

Replaces non-secure screen scraping: Customers will never be asked for their online banking password. Reduces fraud risk and complements compliance processes and obligations.

ACCC-approved bank statements with custom date ranges and data refresh in real-time. Detailed transaction analysis and insights.

Open Banking delivers the highest quality application data for assessment – customised to match each lender’s requirements.

Verified data indicating Open Banking matched data delivers automated approvals for Fastlane processing.

Increase productivity of assessment teams with reduced MIRs and re-works.

The currency and authenticity of customer data is guaranteed with the government-regulated Consumer Data Right (CDR) framework.

Access the latest AI-powered verification of application data.

Open Banking makes it easier and more secure for you to collect financial data from your current banks or lenders (like bank statements, credit card and loan statements) and share with your mortgage broker.

Provided free of charge for consumers.

Secure and government-regulated way to share your financial information, without having to share passwords, or email sensitive documents like bank statements.

Request and receive your bank statements and financial data from your banks in less than 8 minutes (median time for all users).

With an easy to use dashboard, you control which accounts are shared with your broker, and for how long (usually 3, 6 or 12 months). You can also stop sharing data at any time with the click of a button.

Contact us now to learn more about how Open Banking can transform your business.

VOICE OF THE BROKER

Mary Khatchadourian

Director and Broker at Vault Finance

VOICE OF THE BROKER

Michelle Milsom-Wright

Principal at Lendwright Brokerage

Media release

New research reveals how Australian mortgage brokers are transforming their businesses

Learn more

Article

NextGen proudly sponsors the Broker Innovation Summit 2025

Learn more

Article

Empowering brokers: How Open Banking and the Consumer Data Right are reshaping mortgage applications

Learn more

Media release

Connective partners with NextGen to integrate open banking technology, enhancing financial data collection for brokers

Learn more

Subscribe to our newsletter and never miss an update! Get the latest NextGen news and insights, ApplyOnline feature upgrades, and upcoming training webinar dates – all in one place.

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.