Choose the right Application Centre product to match your workflow needs – from comprehensive review capabilities to full-scale application processing and optimisation.

Our platform

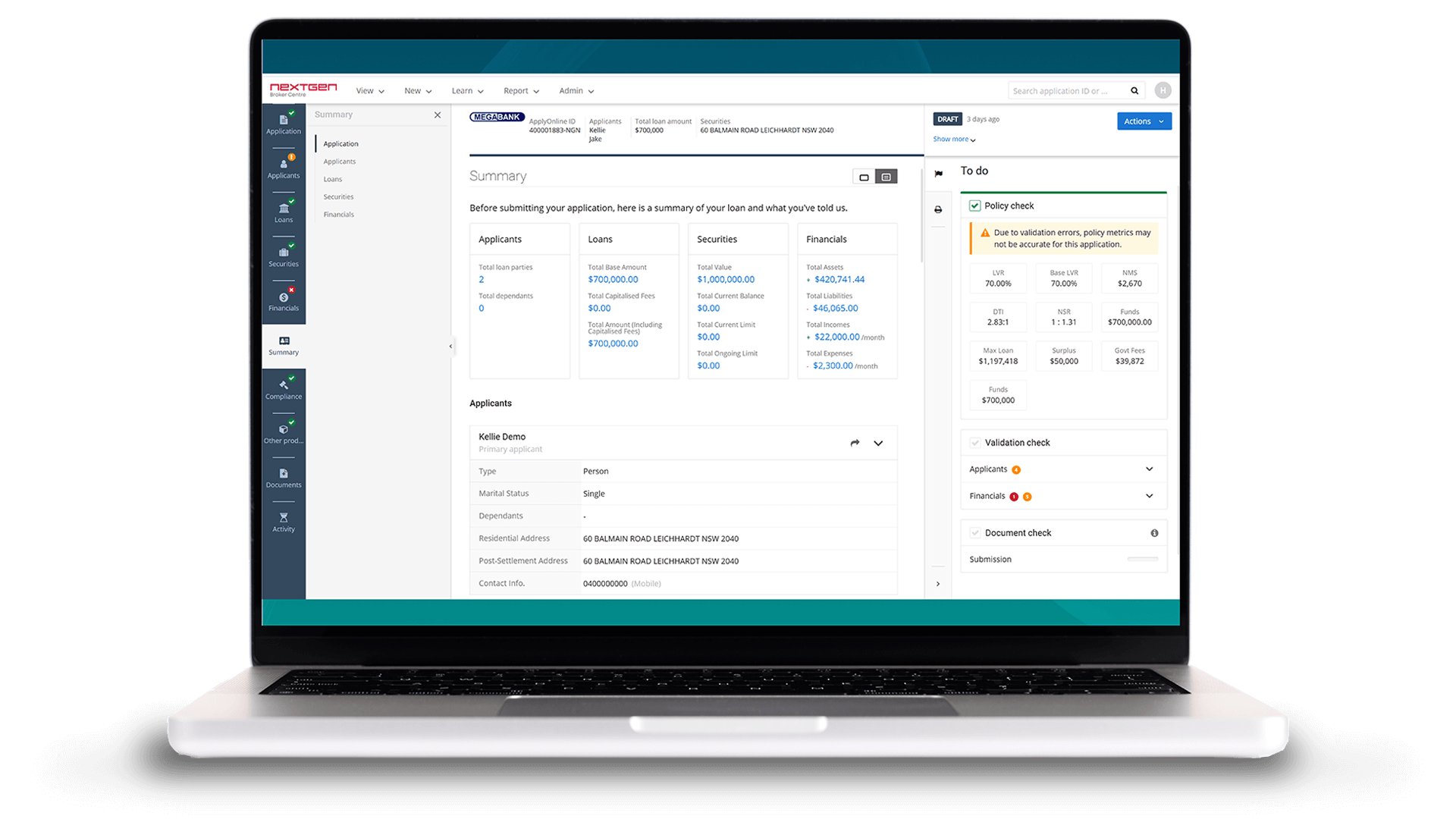

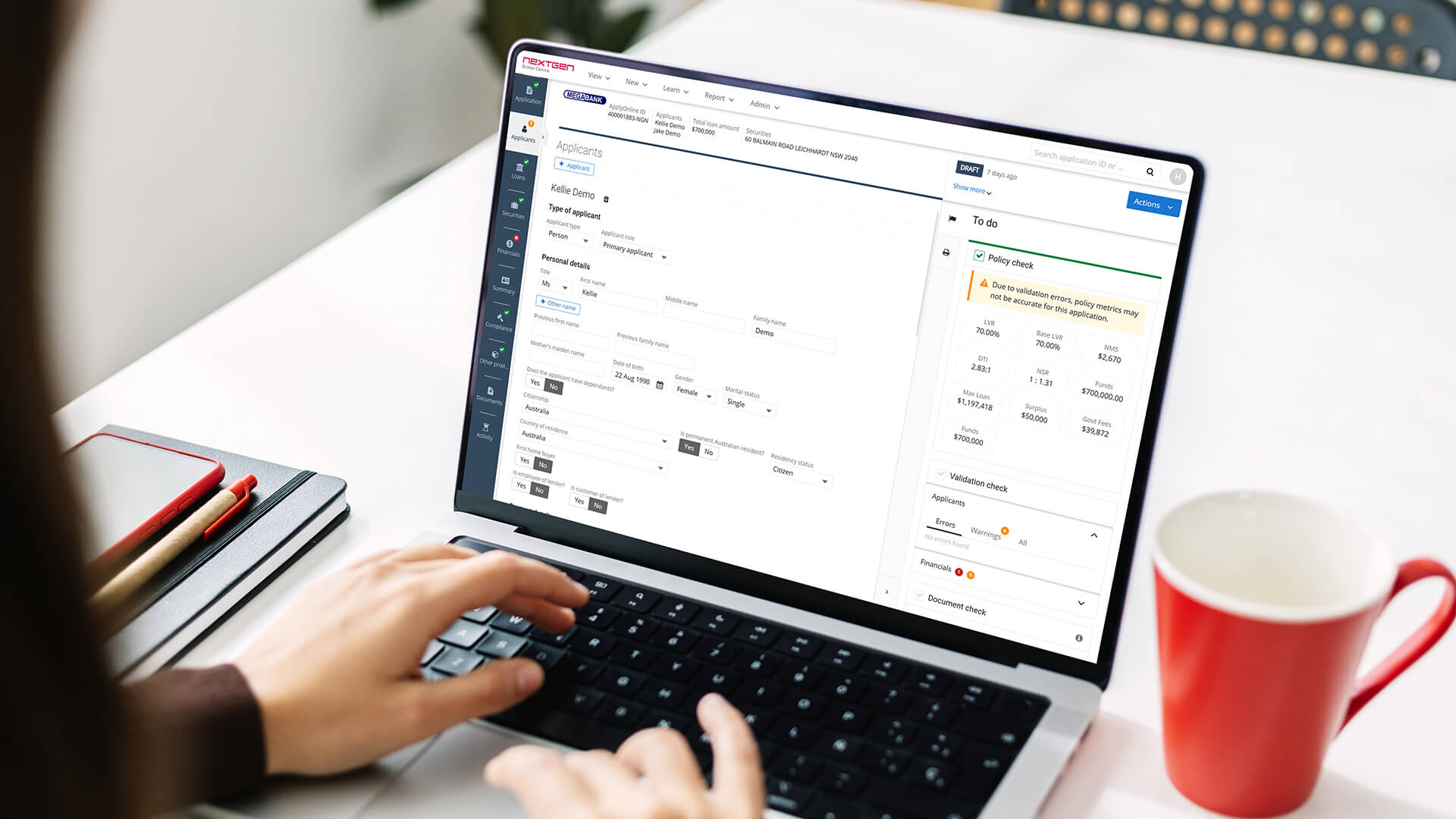

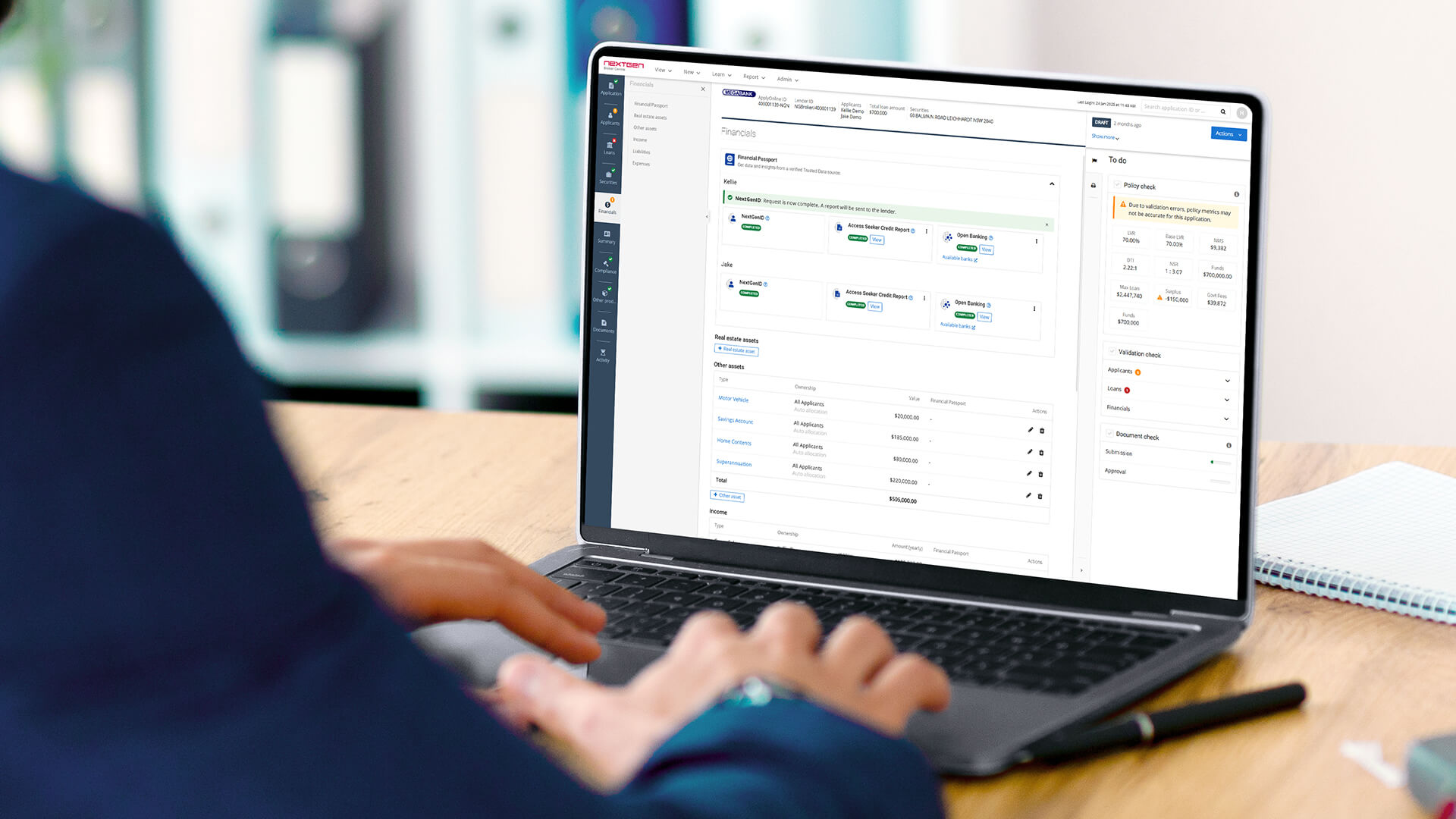

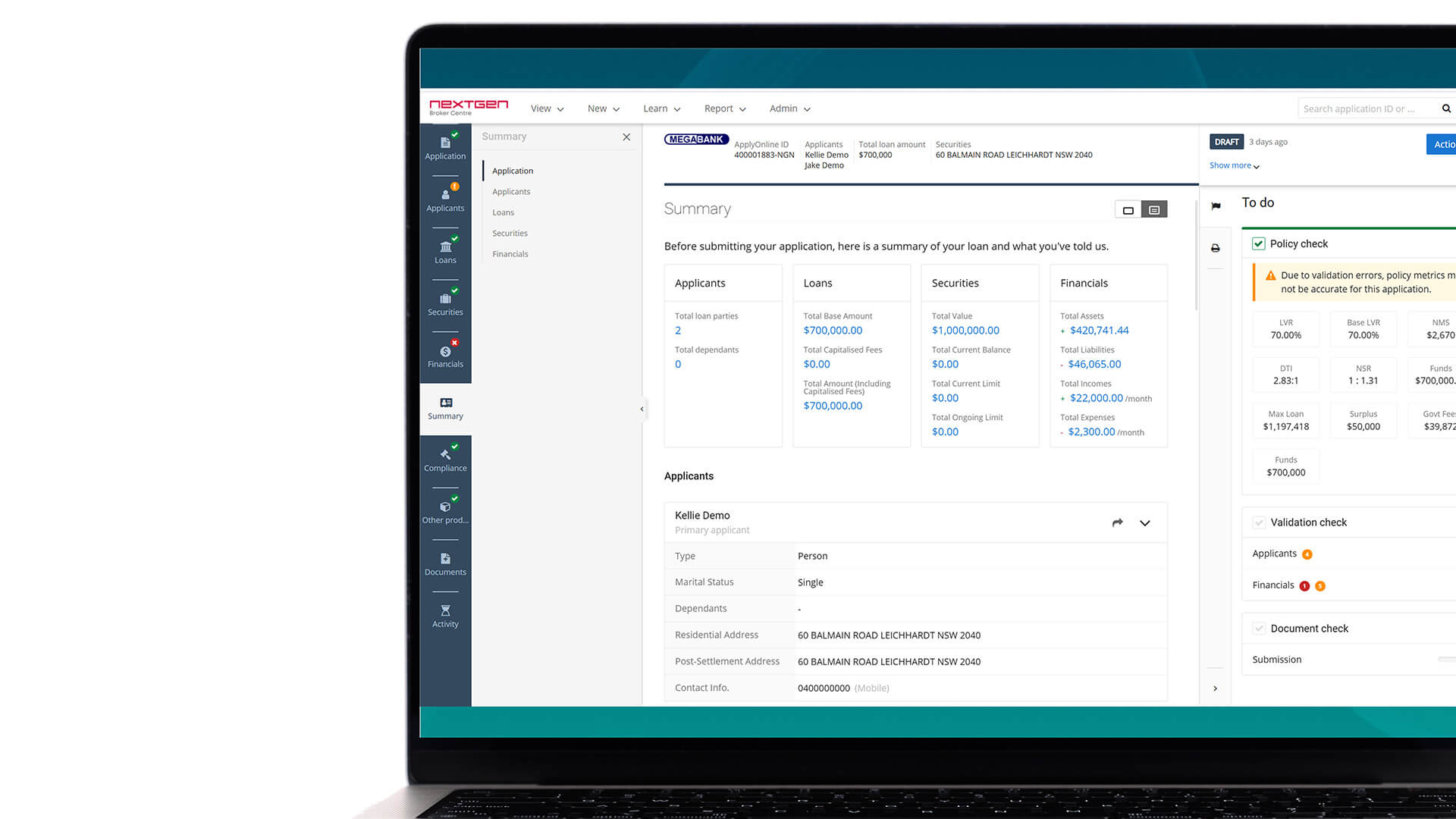

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

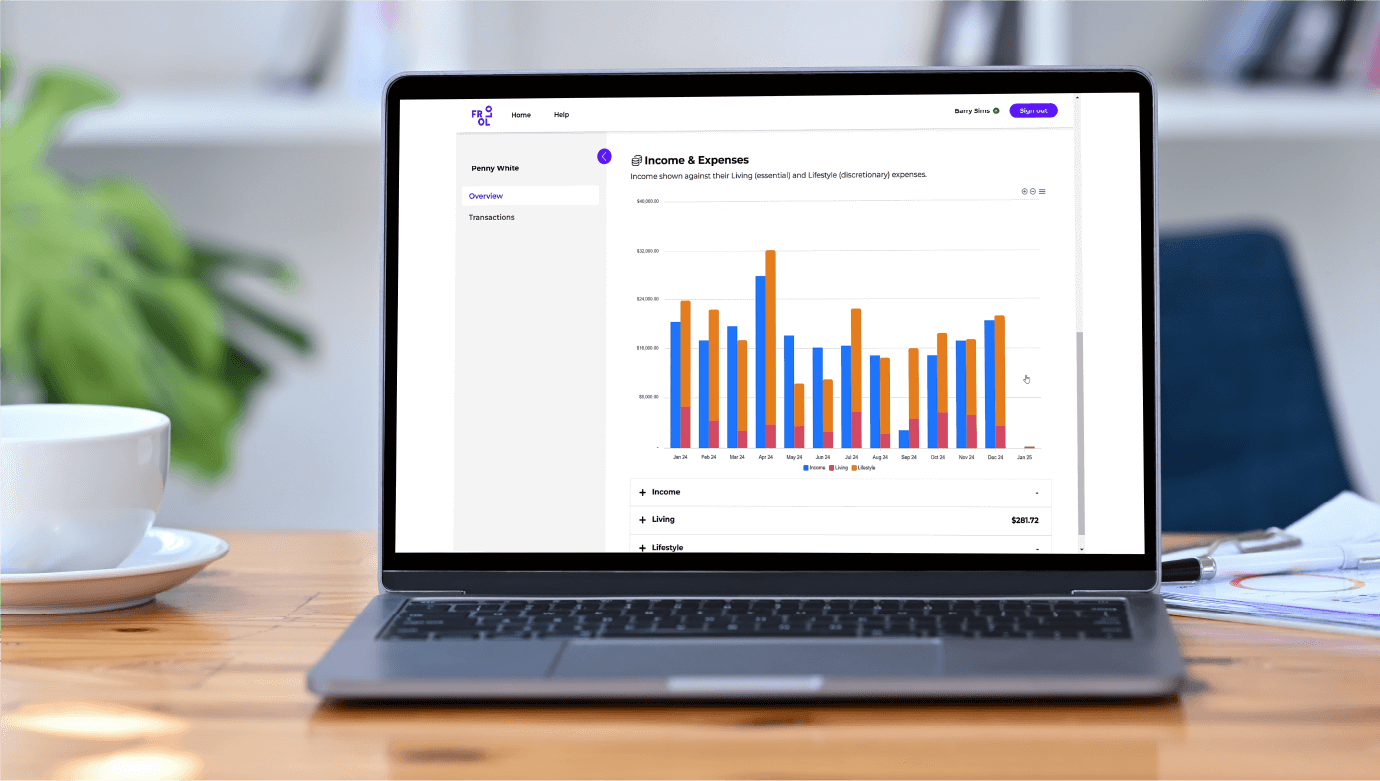

Solutions

USEFUL LINKS