Our platform

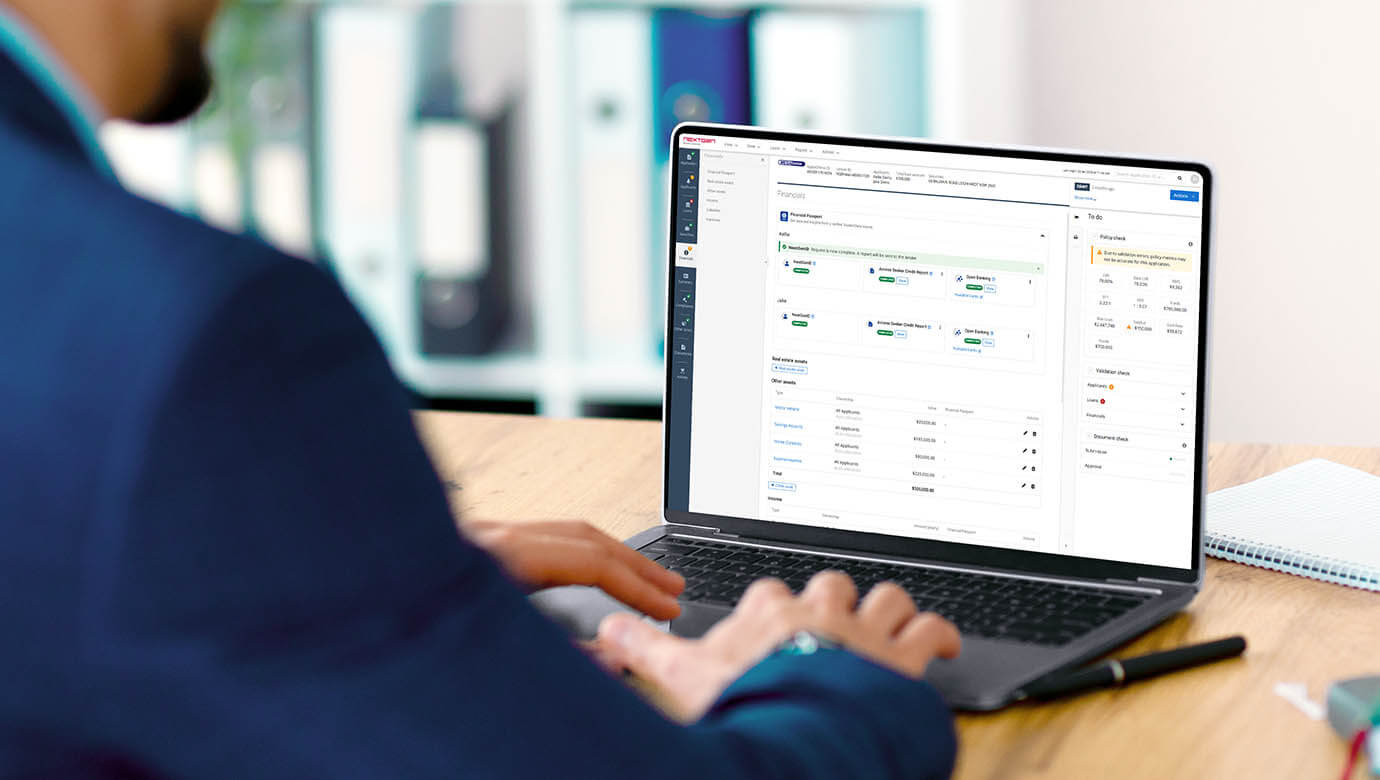

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

We’re excited to share the successful launch of our partnership with MA Money, one of Australia’s fastest-growing non-bank mortgage lenders, who has officially adopted ApplyOnline® as their loan origination platform.

MA Money’s decision to implement ApplyOnline came directly from consistent feedback from their broker network, demonstrating their commitment to providing tools that actually make a difference in day-to-day operations.

The timing of this launch is particularly significant, coinciding with MA Money’s impressive growth trajectory. Having recently surpassed $3 billion in loans under management and completed a landmark $1 billion RMBS transaction, their adoption of ApplyOnline positions them to scale efficiently while maintaining their reputation for exceptional service.

Beyond their residential offering, they’ll also soon be launching commercial loans, SMSF, and bridging loans through ApplyOnline.

The broker response has been overwhelmingly positive, with feedback highlighting the platform’s familiar interface, streamlined processes, and ability to consolidate workflows. For many brokers, having MA Money available through ApplyOnline means one less platform to manage and more time to focus on client relationships.

This partnership exemplifies the ongoing digital transformation in the mortgage industry. By leveraging seamless document management, digital signatures, and paperless processes through ApplyOnline, MA Money is eliminating friction points that can slow down loan submissions and approvals for their brokers.

MA Money’s continued commitment to their 48-hour service level agreement to conditional approval, combined with ApplyOnline’s efficient submission process, creates a powerful combination for broker productivity and client satisfaction.

We’re proud to support MA Money during this significant growth phase and look forward to facilitating their continued expansion through our platform. Their success story reinforces why we remain committed to building tools that empower brokers and lenders alike.

For full details about this partnership announcement, read the complete media release.

ApplyOnline tip

Track your application progress in real-time with the Activity timeline

Learn more

Article

What Australian lenders told us about the future of lending

Learn more

ApplyOnline tip

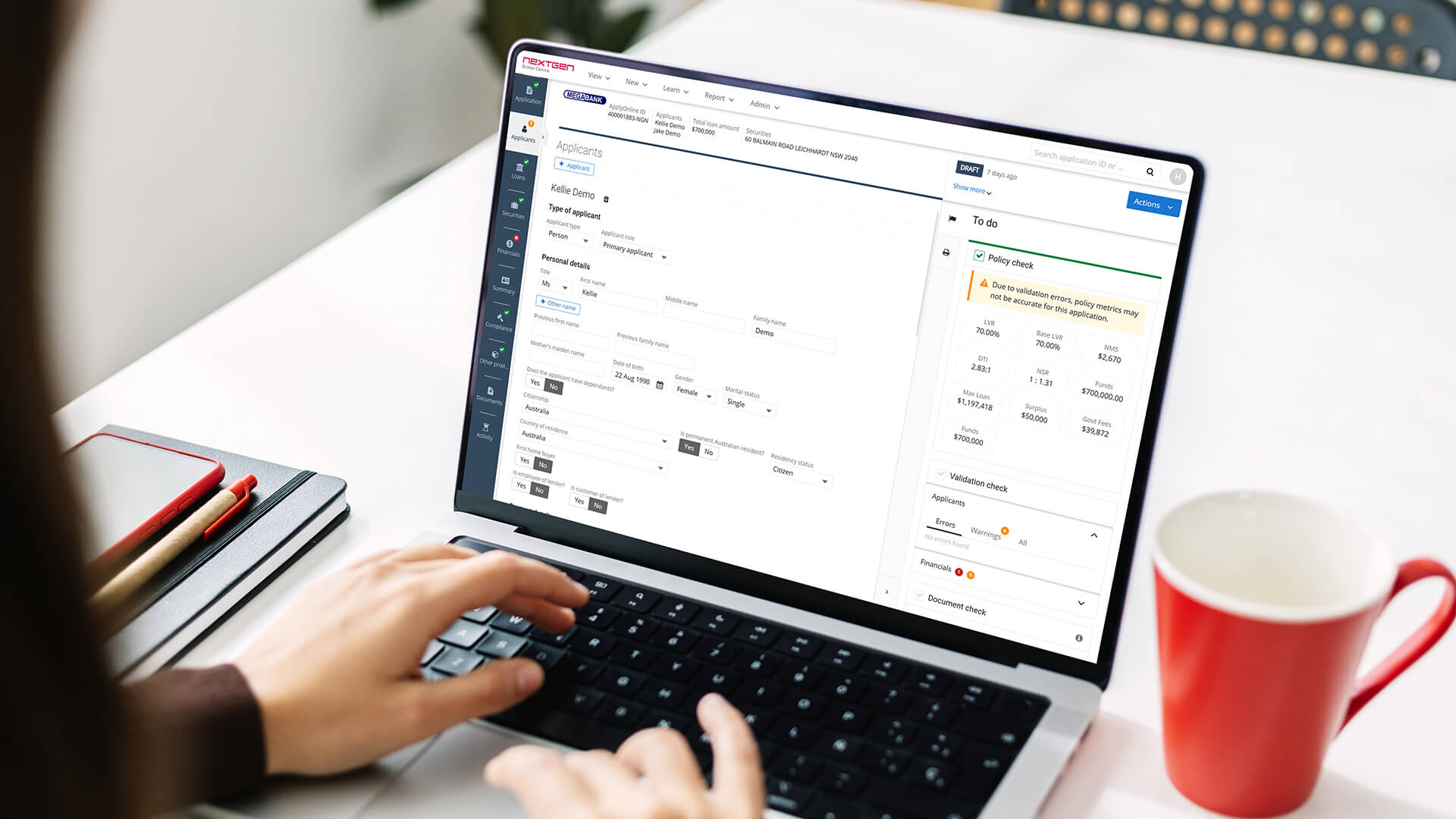

Maximise workspace efficiency with the enhanced ‘policy check’ panel

Learn more

Article

Reverse mortgages now available in ApplyOnline

Learn more

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.