Our platform

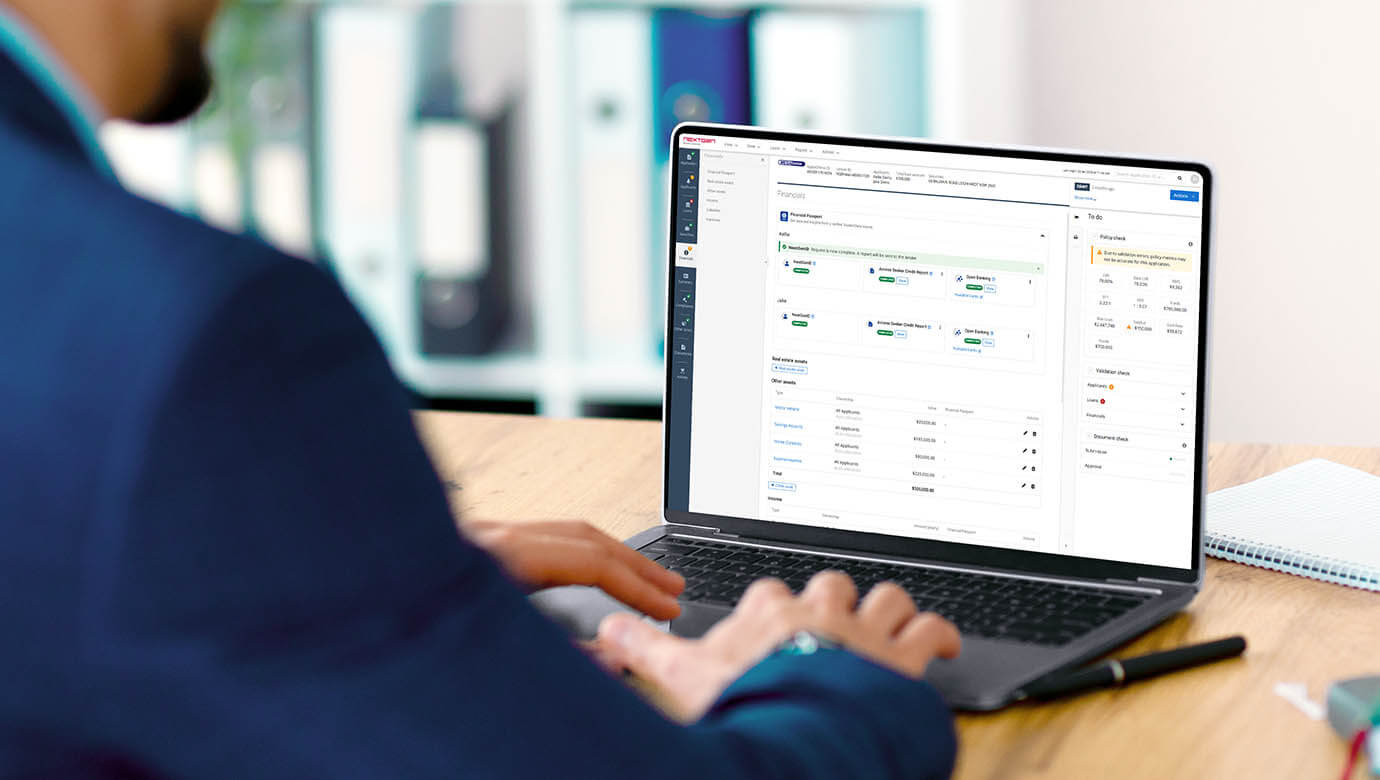

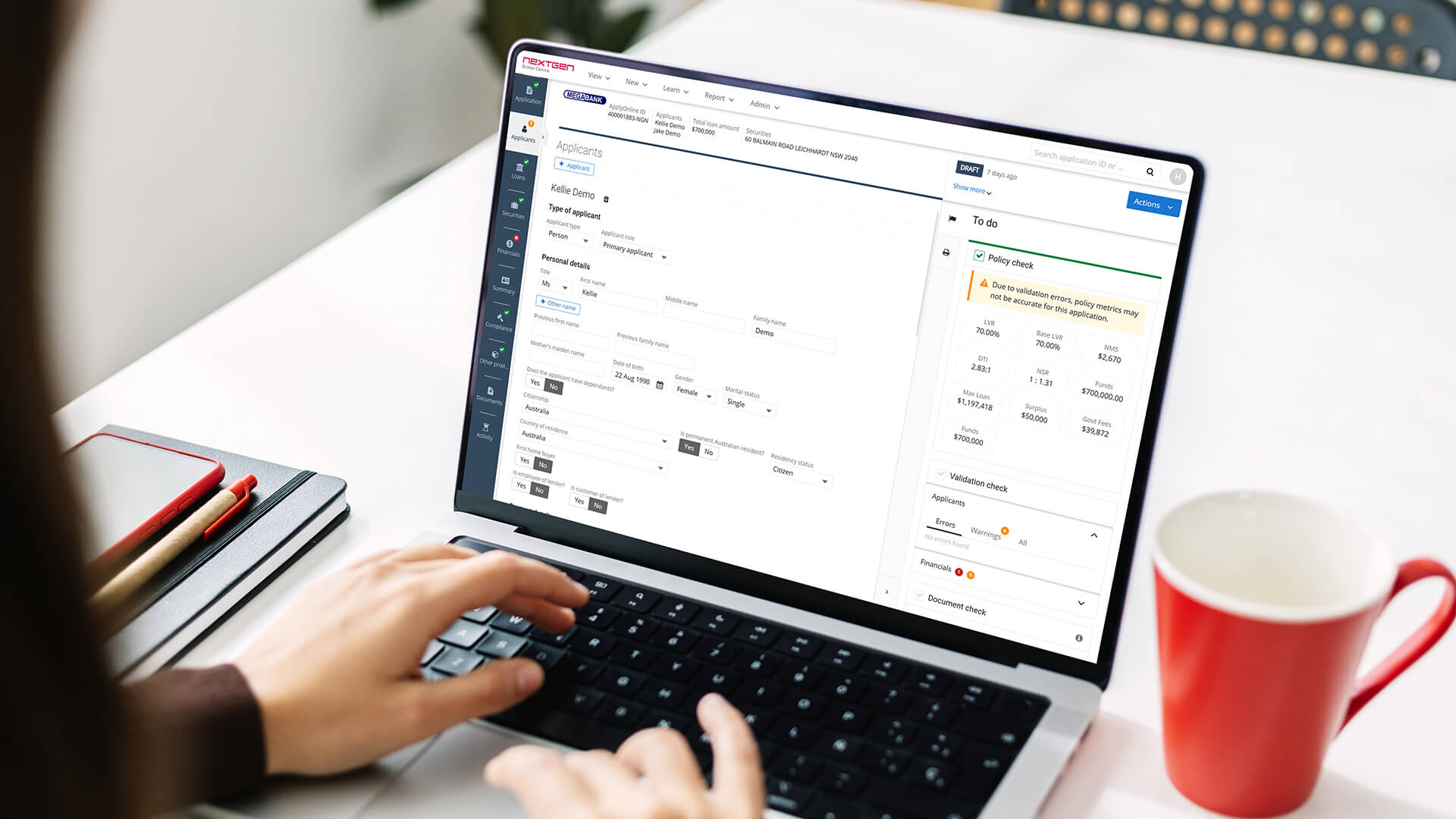

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

NextGen recently conducted research across Australia’s lending sector, gathering insights from participants representing banks, non-bank lenders, and other financial institutions. We’re grateful to everyone who contributed their time and perspectives to this important industry study.

The research explored critical areas including technology adoption, operational challenges, regulatory impacts, and emerging trends shaping the future of lending in Australia.

Manual processing inefficiencies and lengthy approval times emerged as the most significant operational challenges, with the vast majority of respondents identifying faster, more efficient processes as the top priority for remaining competitive.

Artificial intelligence and automation were identified as the trends with the biggest impact over the next two years, while regulatory compliance—particularly AML/CTF obligations and responsible lending requirements—continues to shape technology investment decisions.

Customer experience priorities centre on speed, with faster approvals and reduced wait times ranking as the top priority alongside fully digital application journeys.

The research revealed strong familiarity with NextGen and the ApplyOnline platform among Australian lending institutions, with high levels of trust in the platform’s capabilities.

Open-ended feedback provided valuable direction for the industry’s technology evolution. Respondents emphasised the importance of simplicity and flexibility in a multi-vendor lending environment, with strong architecture and robust APIs becoming increasingly critical as the industry digitises. The message was clear: technology vendors must act as enablers, partnering with lenders to help them achieve their goals.

These insights are directly informing NextGen’s product roadmap and strategic priorities as we continue to evolve the ApplyOnline platform to meet the changing needs of Australia’s lending sector.

Building on these research findings, NextGen will soon release a whitepaper that combines this quantitative data with in-depth interviews with senior lending executives from across the industry, further exploring the trends and strategic imperatives that will define the future of lending technology in Australia.

We thank all participants for their valuable contributions to this research.

Subscribe to our newsletter to be the first to know when the whitepaper is released.

ApplyOnline tip

Track your application progress in real-time with the Activity timeline

Learn more

ApplyOnline tip

Maximise workspace efficiency with the enhanced ‘policy check’ panel

Learn more

Article

Reverse mortgages now available in ApplyOnline

Learn more

Article

The intelligent broker guide: Navigating the next era of mortgage broking

Learn more

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.