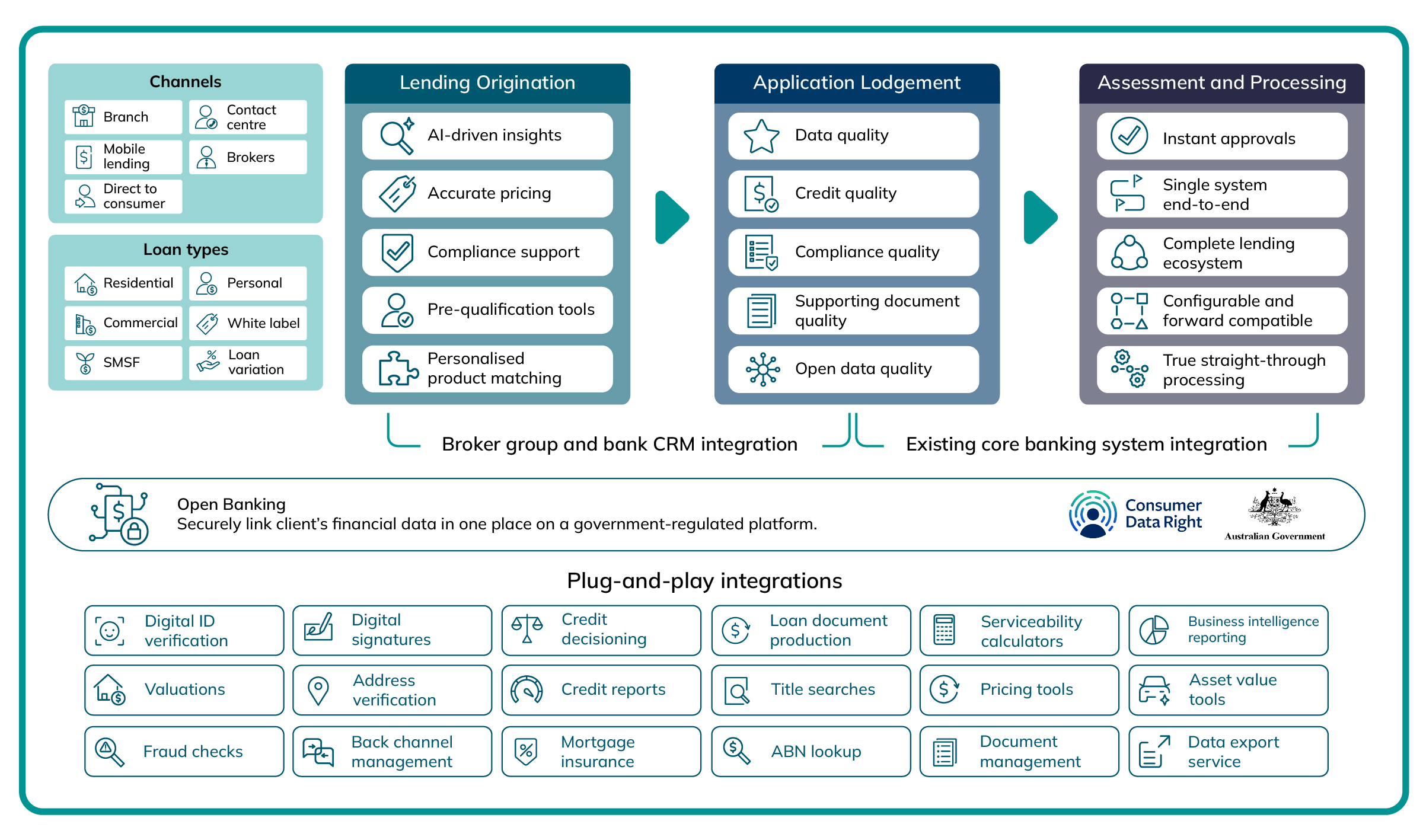

Experience the power of intelligent technology across every step of the lending lifecycle.

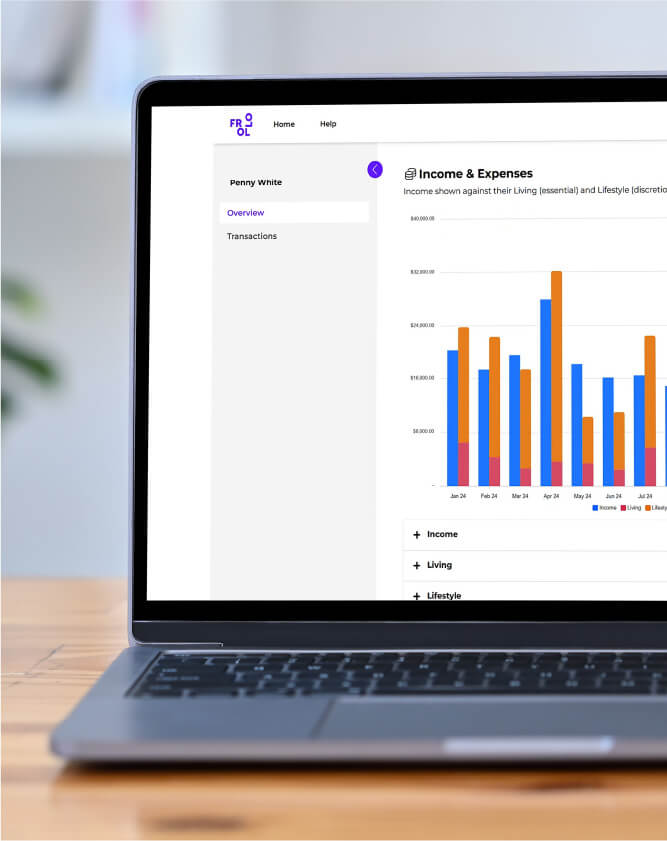

Our platform

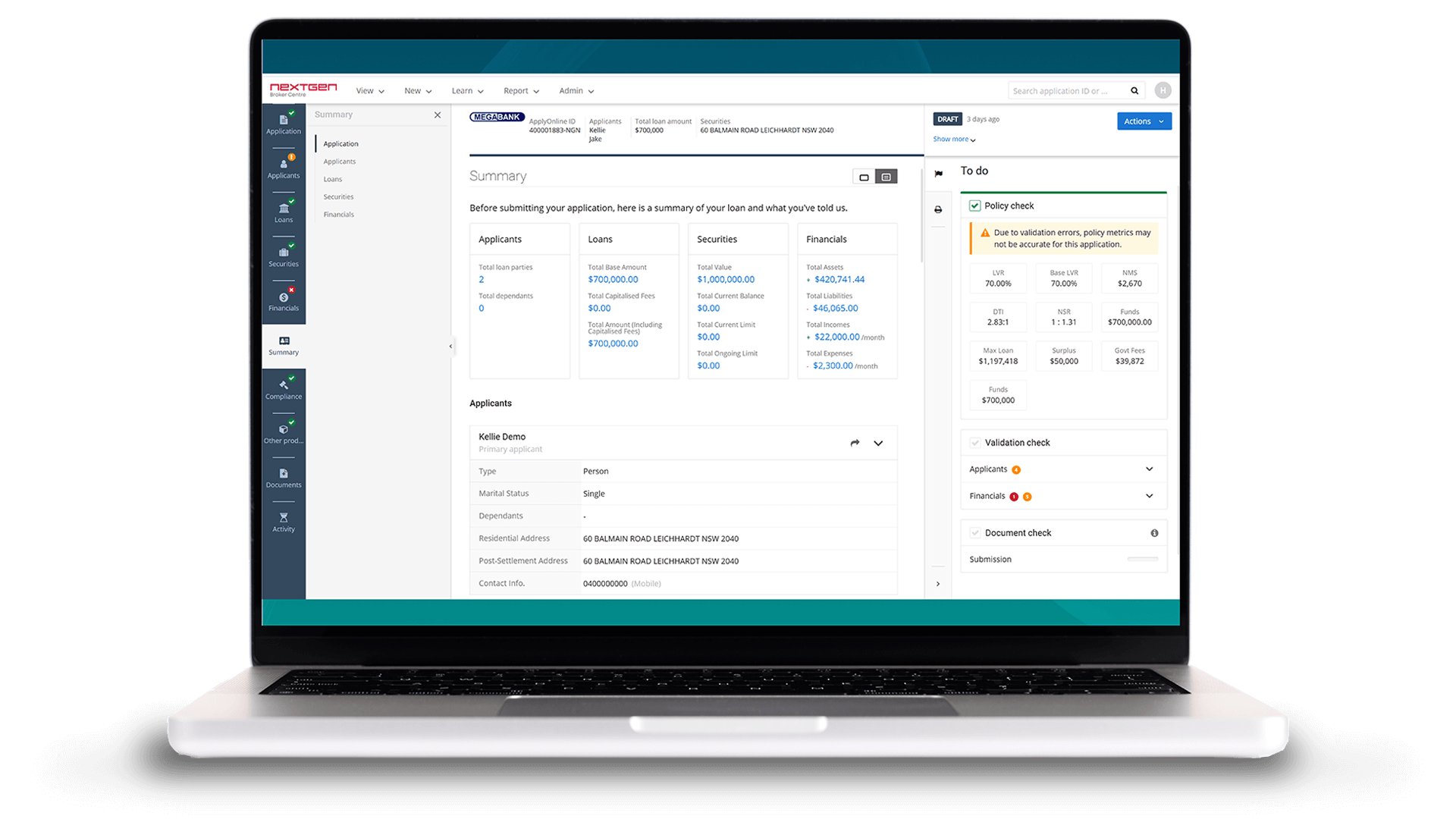

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

-

-

Webinar

Introduction to Open Banking

Useful links