Our platform

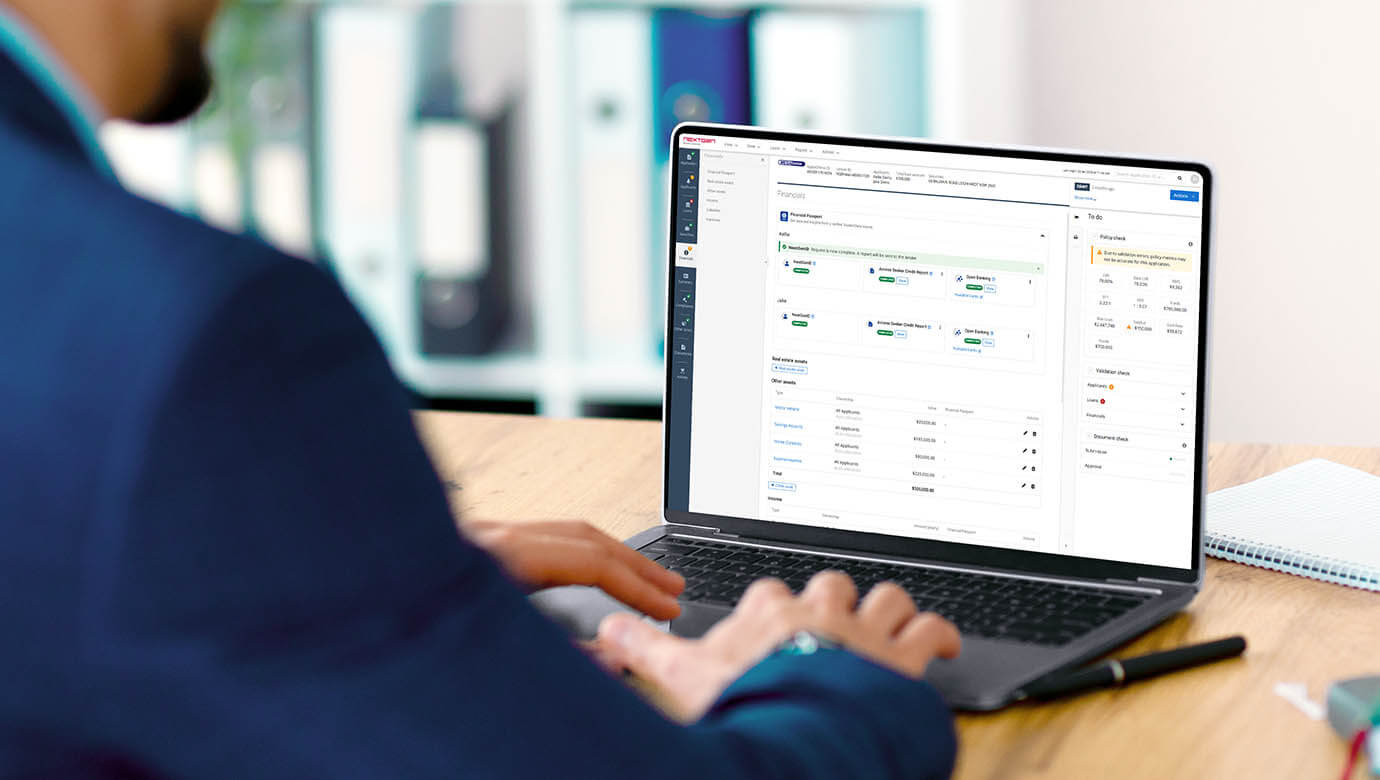

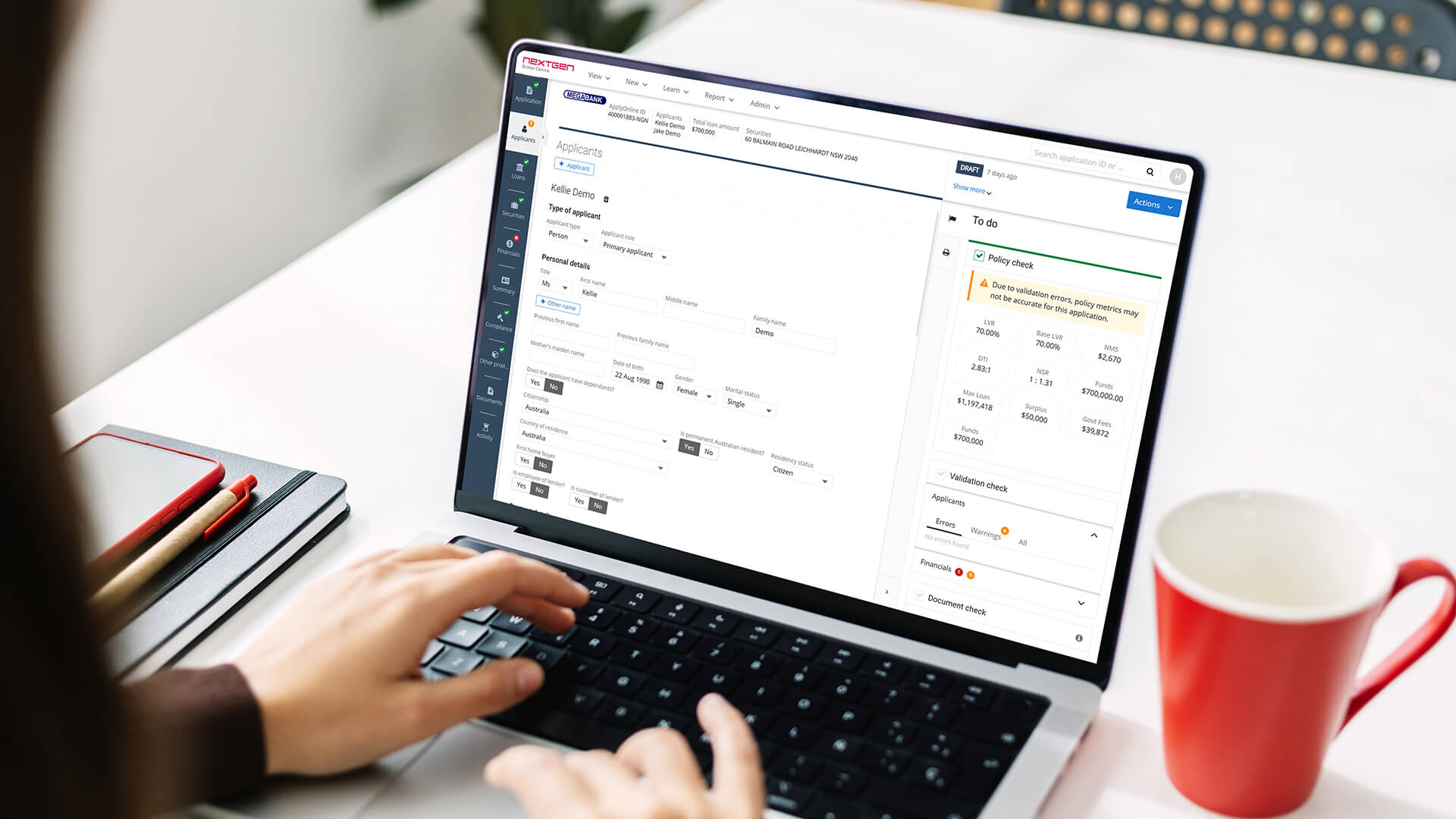

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

In the inaugural episode of NextGen’s Knowledge Series, hosted by the guest interviewer, Melissa Hamilton, Director at Media & Capital Partners, Mike Ponsonby, Head of Lender Partnerships at NextGen, and Simon Docherty, Chief Customer Officer at Frollo, delved into the transformative landscape of open banking and the Consumer Data Right (CDR).

Ponsonby emphasised NextGen’s long-standing involvement in the lending ecosystem, spanning over three decades, and highlighted their strategic partnerships with over 60 lending institutions and industry bodies. The conversation pivoted to the evolution of open banking and CDR, with Ponsonby lauding the innovation around customer data and how the CDR opened up new avenues for NextGen to enhance its capabilities.

Notably, NextGen’s acquisition of Frollo, the first organisation to be granted an unrestricted banking licence, marked a pivotal moment in NextGen’s journey. Mike underscored Frollo’s best-in-market capabilities in the open banking space which presented NextGen with “a fantastic opportunity for us to be more innovative in using customer data to make the home loan process very fast and simple” right from the start of the borrower’s application experience.

The discussion revolved around the critical role Frollo plays as an open banking services provider, focusing on customer consent and data collection. Docherty underscored the significance of quality data and its impact on the lending process, particularly in categories such as lending and money management, as it is increasingly used by lenders to build a greater customer experience.

Ponsonby offered valuable insights into the number of data holders in lending, underscoring the program’s inclusivity and scale: “There’s over 114 Data Holders … [which] captures nearly 99% of Australian deposits … within the CDR programme, which is fantastic! [It speaks to] how inclusive the programme is [and] how successful it can be”.

The duo then delved into the implications of open banking for both customers and lenders and its potential to offer a more sustainable and streamlined lending experience. Ponsonby highlighted that a “significant capability lies in enhancing the ease with which customers gather information to become fit for finance. Despite receiving over a million home loan applications annually across various lenders, our data analysis reveals that over 80% of them require additional information. The key enhancement we observe is in the quality of applications received from customers via brokers, resulting in a faster and more efficient experience—a critical capability derived from open banking.”

A significant portion of the conversation focused on the rollout of open banking with mortgage brokers and lenders. Ponsonby detailed NextGen’s current focus not only on enhancing the ease with which customers gather and submit information, but also building the technology to further streamline the ApplyOnline home application and assessment process.

“At the next level down, our focus is on significant challenges, particularly in categorising raw data. Acquiring the data is one part of the puzzle; however, crucial steps involve categorisation and ensuring its usability. Detecting income, for instance, poses a major challenge in data categorisation, and we are deeply committed to addressing and enhancing the accuracy of this process.”

Docherty touched upon the security aspect of open banking, highlighting its government-regulated nature and its potential to replace less secure practices like screen scraping. The potential ban on screen scraping was discussed, with both speakers expressing support for such a move, emphasising the superior security and efficiency of open banking.

The discussion concluded with a forward-looking perspective. Docherty envisioned a revolution and evolution in lending, citing the ongoing impact of open banking on consumer experiences. Ponsonby echoed these sentiments, anticipating 2024 as the start of a transformational phase in open banking.

Watch Episode 1 of the NextGen Knowledge Series below. Look out for the next episode in early 2024.

ApplyOnline tip

Track your application progress in real-time with the Activity timeline

Learn more

Article

What Australian lenders told us about the future of lending

Learn more

ApplyOnline tip

Maximise workspace efficiency with the enhanced ‘policy check’ panel

Learn more

Article

Reverse mortgages now available in ApplyOnline

Learn more

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.