Our platform

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

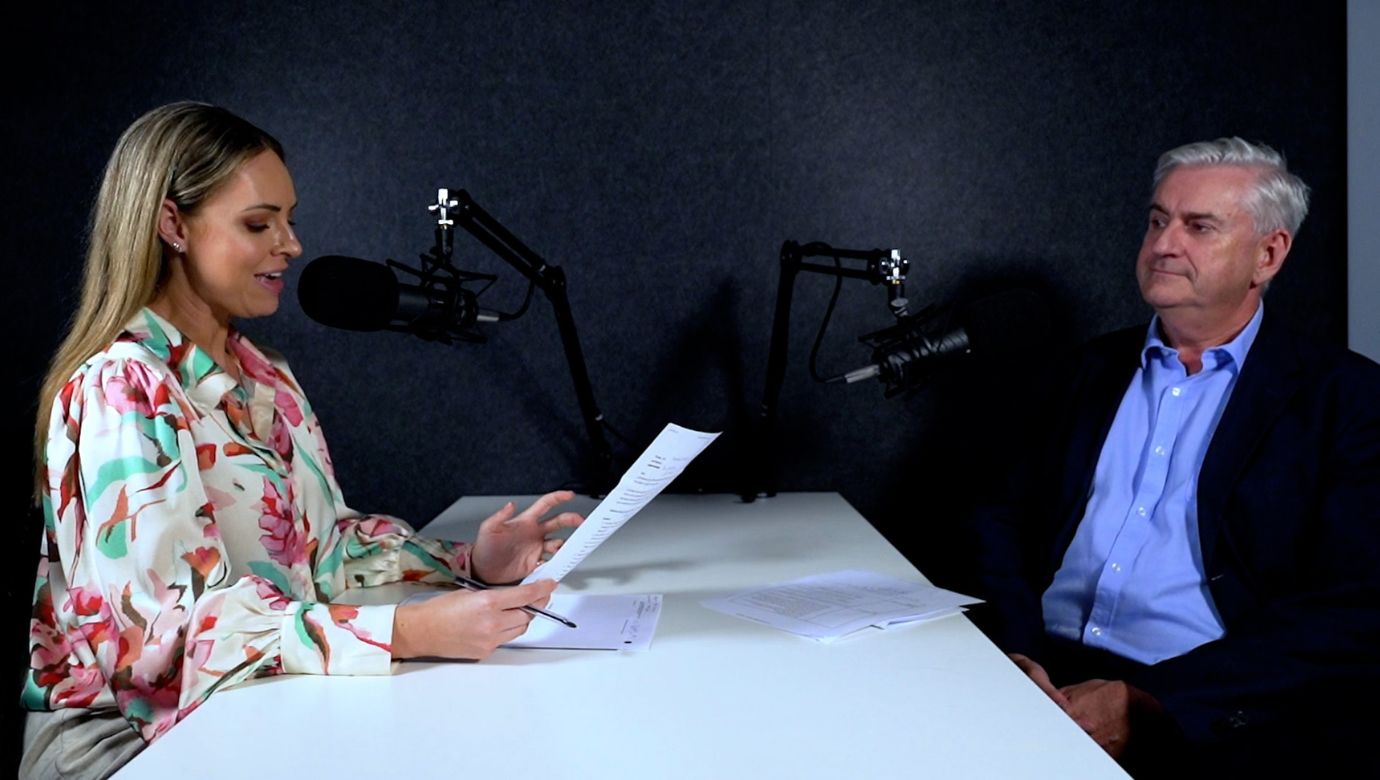

In Episode 2 of the NextGen Knowledge Series, journalist and media personality, Julie Snook, interviewed Tony Carn, Chief Customer Officer at NextGen. They discuss the key themes shaping the lending landscape in 2024.

Efficiency is at the forefront of lenders’ priorities, aiming to cut down costs and enhance the mortgage application process. Carn emphasises the need for a superior customer experience, reduced reworks, and faster approval times. Technology leadership emerges as a crucial theme, with early adoption providing a strategic advantage. There is also a significant movement towards embedding more information upfront to boost application quality and leveraging open banking data to further enhance the application process.

Carn notes the substantial investments over the past three years in open banking. The benefits include improved customer experiences, reduced fraud, and increased efficiency. Carn predicts an acceleration in 2024, with open banking data accessible to more mortgage brokers.

“We have a number of aggregators that have already enabled [open banking] which has been fantastic. And we now have the first lender, being the largest in the country, CBA, that has enabled [open banking] as well. A number of lenders in the first quarter and second quarter next year will also enable that data to be used in their mortgage application.”

Change management and education are identified as essential factors for industry adaptation.

Regulatory changes, including the eventual ban on screen scraping, highlight the paramount importance of trust and security in the lending process.

“We were seeing around a 30% completion rate a year ago, and now we’re seeing well in excess of 70%. So, we’re seeing the trust is there. Trust is really important to actually collect information from a consumer; that’s really, really important.”

Carn positions open banking data as a superior alternative, offering lenders the ability to recognise the authenticity and currency of data and enhancing trust in the information provided by applicants.

Facing real challenges in fast turnaround times, cost-cutting, and heightened competition, brokers and lenders are navigating a complex landscape. Carn’s advice to lenders, aggregators, and brokers is clear – embrace change and prioritise efficiency. In a landscape where trust, security, and precision matter, he urges industry players to invest in education and understanding the open banking process. Brokers, recognised as Trusted Advisors, have a strategic advantage as regulators enable consumers to share data with them.

Listen to the full conversation to gain a deeper understanding of the evolving lending landscape in 2024.

Article

Unlocking real-time data collection: Frollo launches Open Banking portal for brokers

Learn more

Article

NextGen and RedZed celebrate successful partnership

Learn more

Article

NextGen proudly sponsors the Broker Innovation Summit 2025

Learn more

ApplyOnline news

New enhancements to ApplyOnline eSign: Streamlining your digital signature process

Learn more

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.