Our platform

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

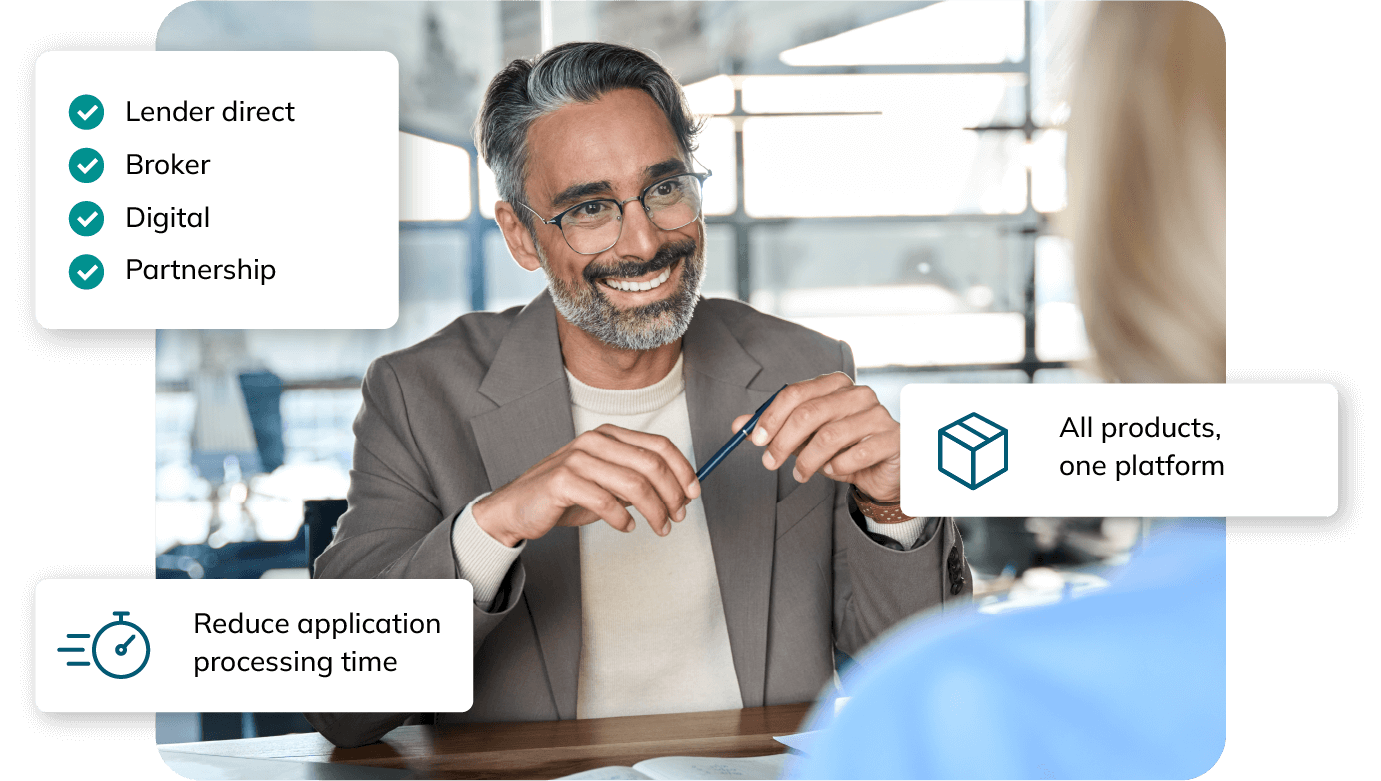

Transform your lending with a unified platform that drives efficiency across all channels.

Flexible distribution through brokers, retail, and direct channels with proven solutions for origination growth.

Drive efficiency with a unified platform handling all residential, commercial, and personal lending products seamlessly.

Enable superior digital lending with the market-leading and most innovative electronic application ecosystem.

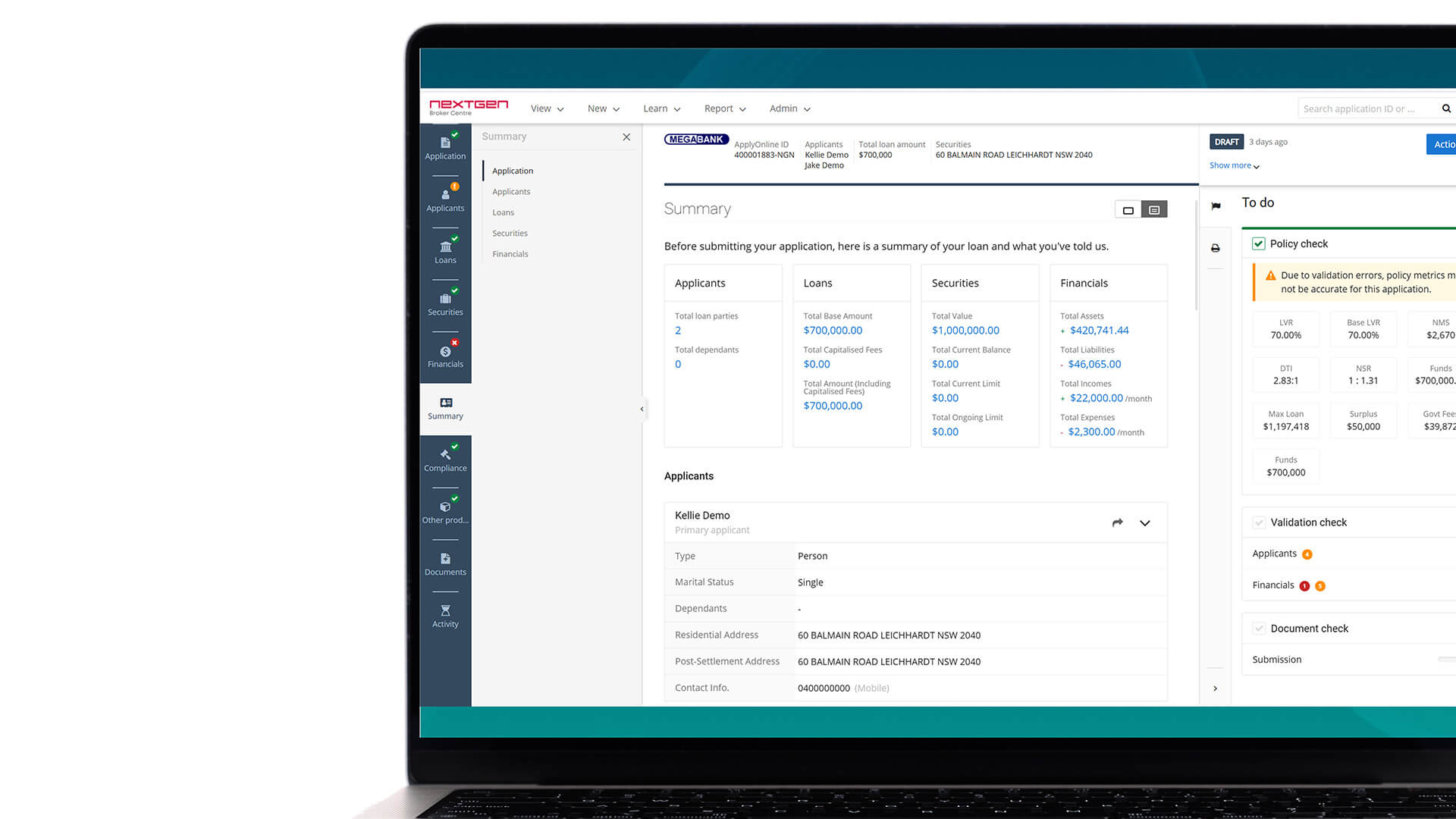

Streamline lending from application to settlement by ensuring application quality at the point of submission.

Our origination solutions cater to a diverse range of lending products beyond traditional home loans.

Direct channel origination

Streamline applications across branches, mobile lenders, call centres and online.

Don’t get left behind – reach 97% of brokers through their trusted platform.

Case study

Braden Bird and Jayne Kerford

Product & ESG Officer at RedZed and Chief Risk Officer at RedZed

Reduction in processing time

Digital submission rate achieved

Minutes per application processing

Case study

Nick May and Wendy den Hartog

Chief Customer Officer and Senior Manager for Lending Process and Optimisation at Beyond Bank Australia

Days faster end-to-end loan processing

Applications now use auto-decisioning

Point increase in NPS score

CASE STUDY

Shane Kuret and Rachel Morley

Chief Information Officer and Chief Growth and Experience Officer at BankVic

Reduced time to decision

Broker applications in first year of new market

Enhanced member experience and seamless operations across all lending channels

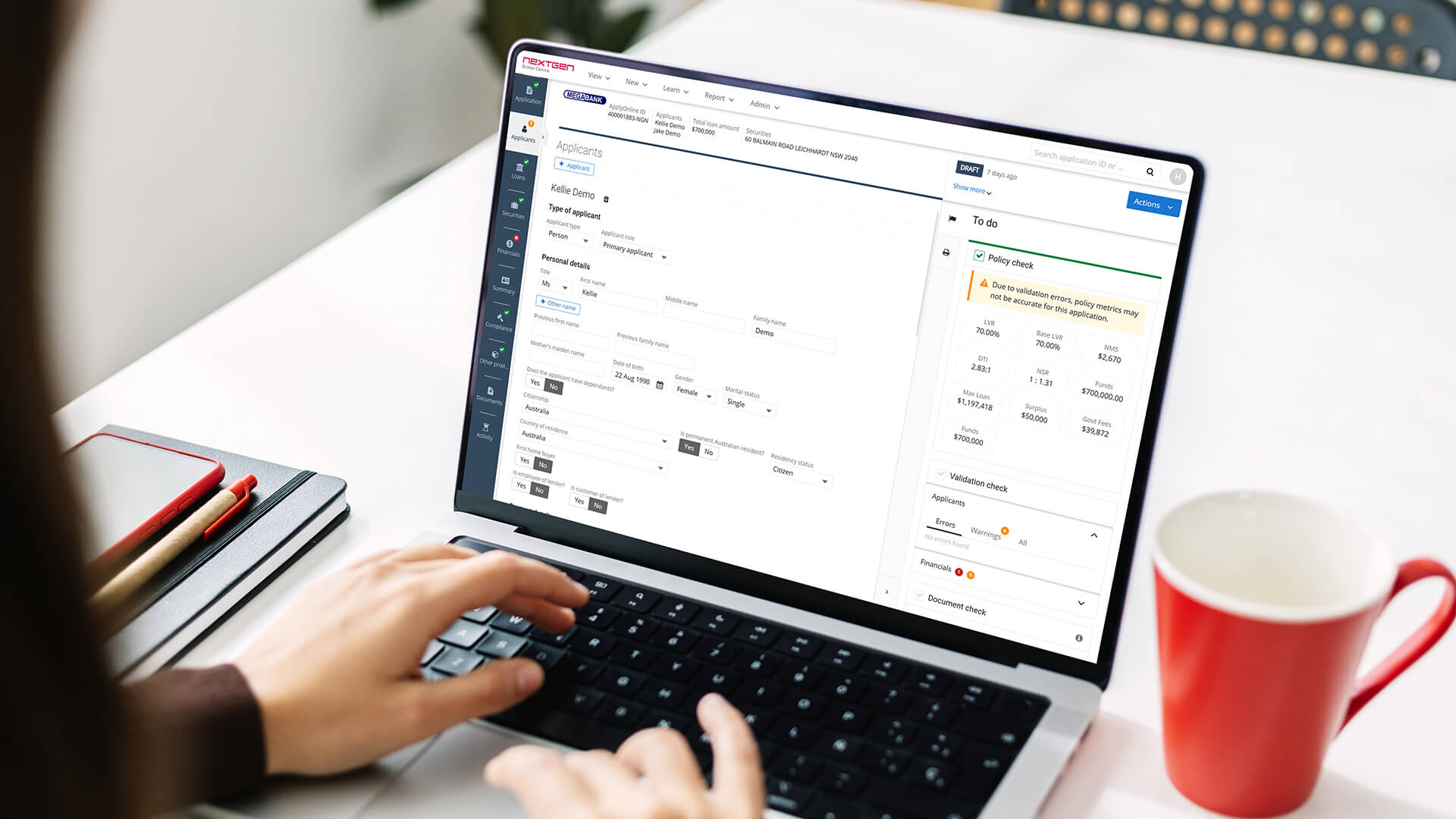

Serviceability Assessment

Transform borrower assessments into loan applications seamlessly with integrated serviceability tools.

ApplyOnline supports a broad spectrum of lending products.

Accommodate all borrower types including: self employed, multiple borrowers, trusts and companies.

Efficiently process commercial property loans with precision tools that streamline documentation and approval.

Streamline post-settlement loan variation applications with an efficient digital process.

Manage complex construction applications with purpose-built tools for land, build, and progressive drawdown stages.

Capture complex bridging scenarios effortlessly with intuitive tools for peak debt and ongoing loans.

Simplify SMSF loan applications with dedicated tools for investment and refinancing requirements.

Capture senior equity release applications with specialised workflows designed for complex lending requirements.

Easily distribute and manage multiple lending brands through a single, unified platform.

Process personal loans with powerful calculators, automated workflows, and comprehensive data integration.

Integrate credit card applications seamlessly into your existing lending workflow system.

Integrate mortgage insurance applications seamlessly into your lending workflow for efficient processing.

Efficiently manage unique lending requirements, from Sharia-compliant loans to asset finance applications.

Transform your legacy lending systems into modern, customer-centric processes to maximise efficiency and digital capabilities.

Article

Unlocking the ease of commercial distribution

Learn more

Media release

NextGen launches Open Banking-powered Automated Income Verification in ApplyOnline

Learn more

Media release

RedZed expands ApplyOnline partnership to include commercial and SMSF loan applications

Learn more

Article

The future of mutual banking: Insights from industry leaders

Learn more

Contact us to discover how ApplyOnline can enhance your business. Elevate your lending origination operations with unmatched efficiency, reliability, and innovation.

Subscribe to our newsletter and never miss an update! Get the latest NextGen news and insights, ApplyOnline feature upgrades, and upcoming training webinar dates – all in one place.

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.