Reduce operational costs through automated processing, advanced validation, and streamlined point-of-sale workflows.

Our platform

ApplyOnline®

Our innovative end-to-end lending solution.

Learn more

Solutions

USEFUL LINKS

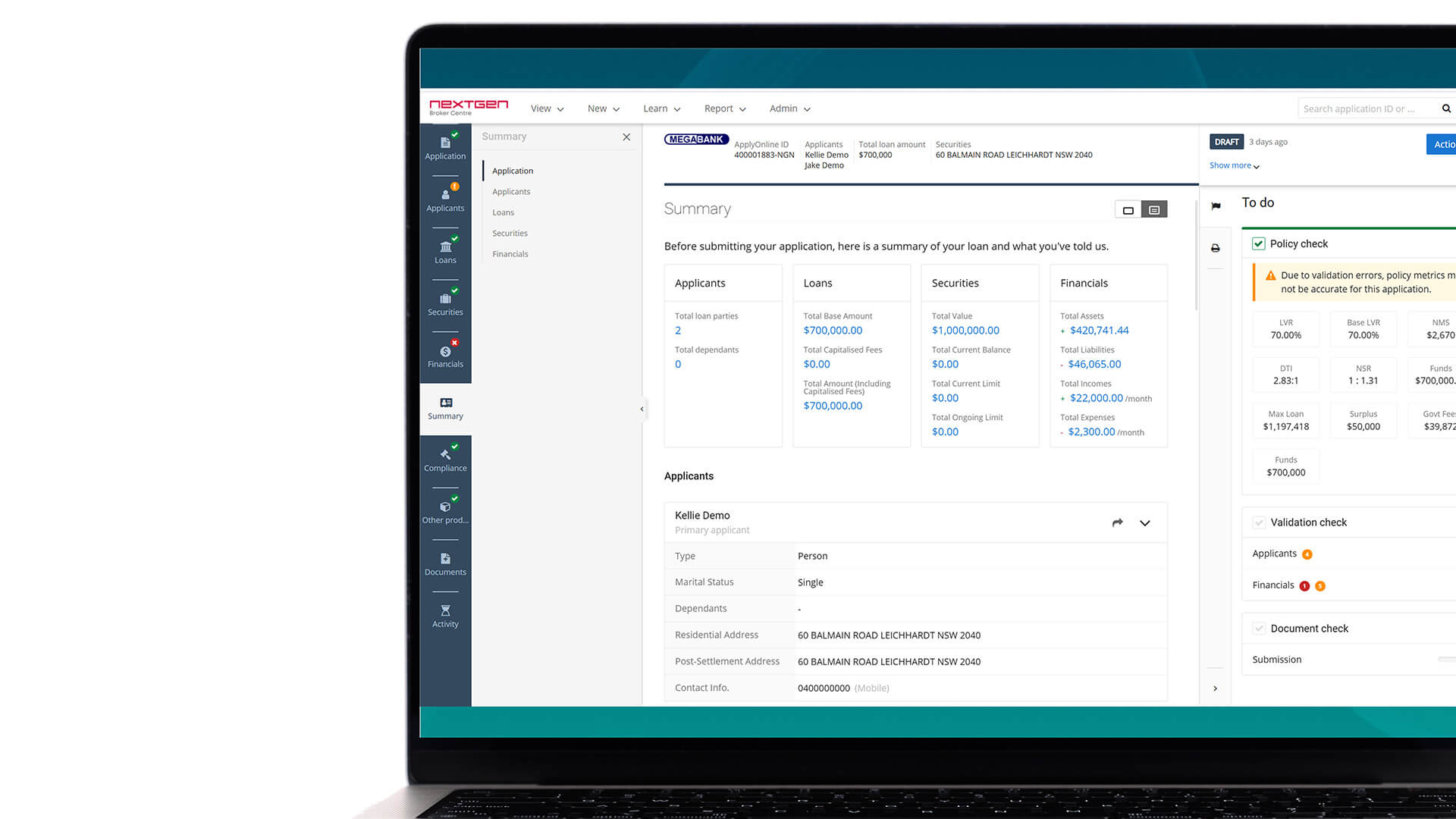

ApplyOnline® sets the industry benchmark for electronic loan application lodgement in Australia, ensuring efficiency, security, and compliance.

Reduce operational costs through automated processing, advanced validation, and streamlined point-of-sale workflows.

Connect seamlessly with CRM, lender systems, and third-party services to source pre-validated application data.

Ensure accurate loan submissions with real-time policy updates, dynamic assessment tools and regulatory compliance assurance.

Drastically reduce time-to-yes and drive straight-through processing supported by real-time data monitoring and benchmarking.

Brokers already know and trust our platform, ensuring smooth adoption and immediate loan submissions.

Connect with more brokers through the industry’s leading platform.

Reduce operational costs through automated processing, advanced validation, and streamlined point-of-sale workflows.

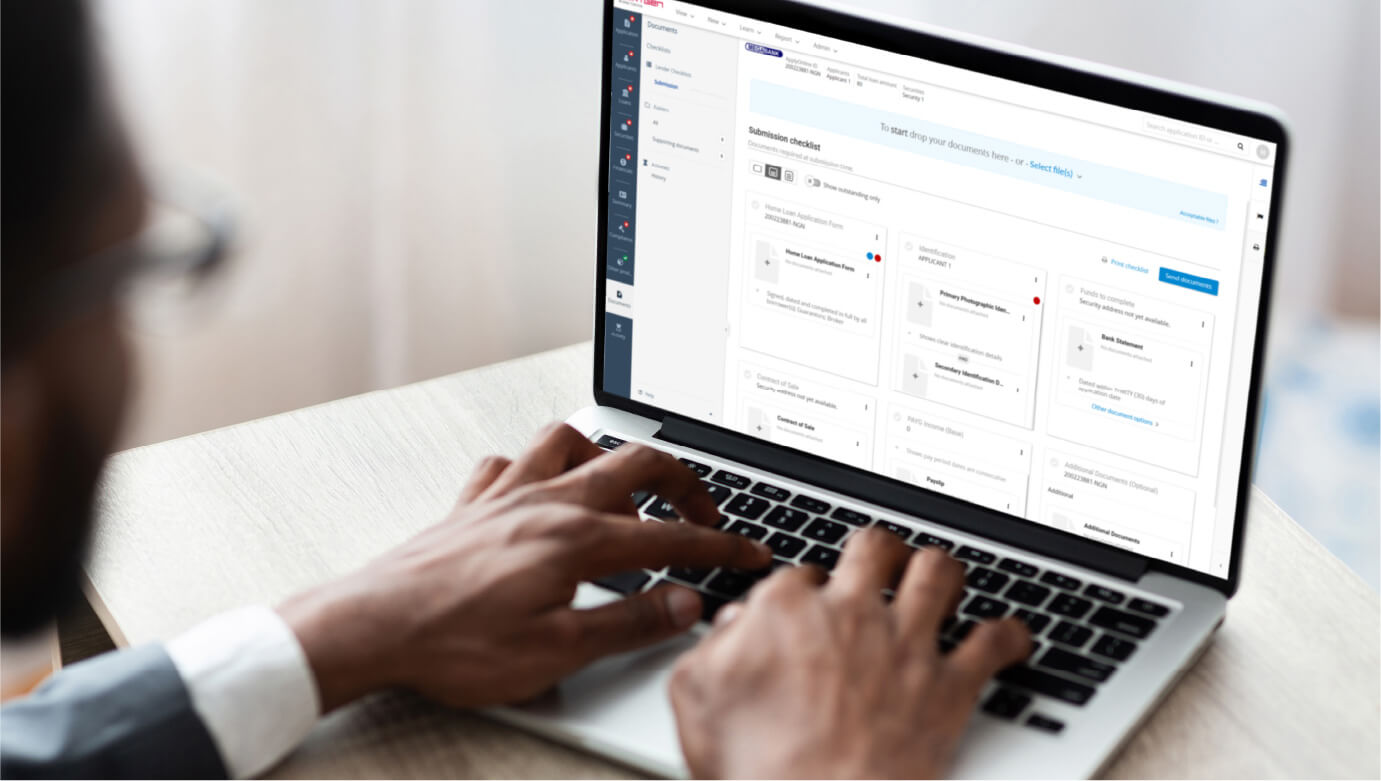

Digital Efficiency

Intelligent checklists and streamlined document management boost approval rates and accelerate loan processing.

Centralise and organise all loan documentation in one secure, easily accessible digital location.

Convert to fully digital document collection and storage for faster, more efficient loan processing.

Accelerate document completion with secure electronic signatures, eliminating paper-based signing delays.

Smart, dynamic checklists ensure complete documentation with clear, step-by-step guidance.

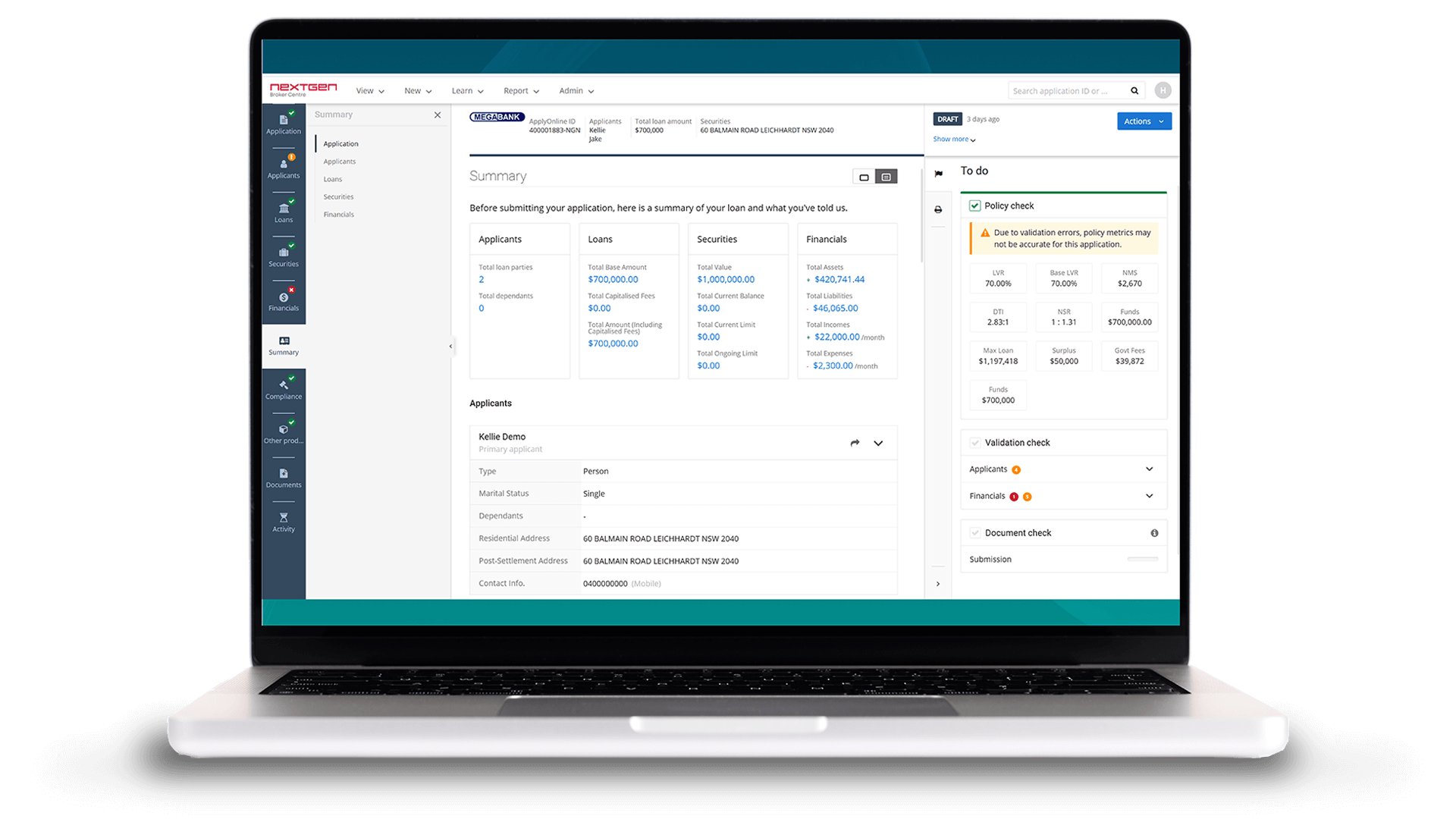

Smart decisioning

Calculate serviceability and validate policy requirements in real-time for more accurate loan submissions.

Complex policy rules automatically assess to determine loan eligibility and highlight potential issues.

Immediate insights on application quality and compliance before submission to prevent reworks.

Dynamic policy updates enabled to all submissions align with current lending criteria and requirements.

Accurate serviceability and borrowing capacity calculated instantly as application details are entered.

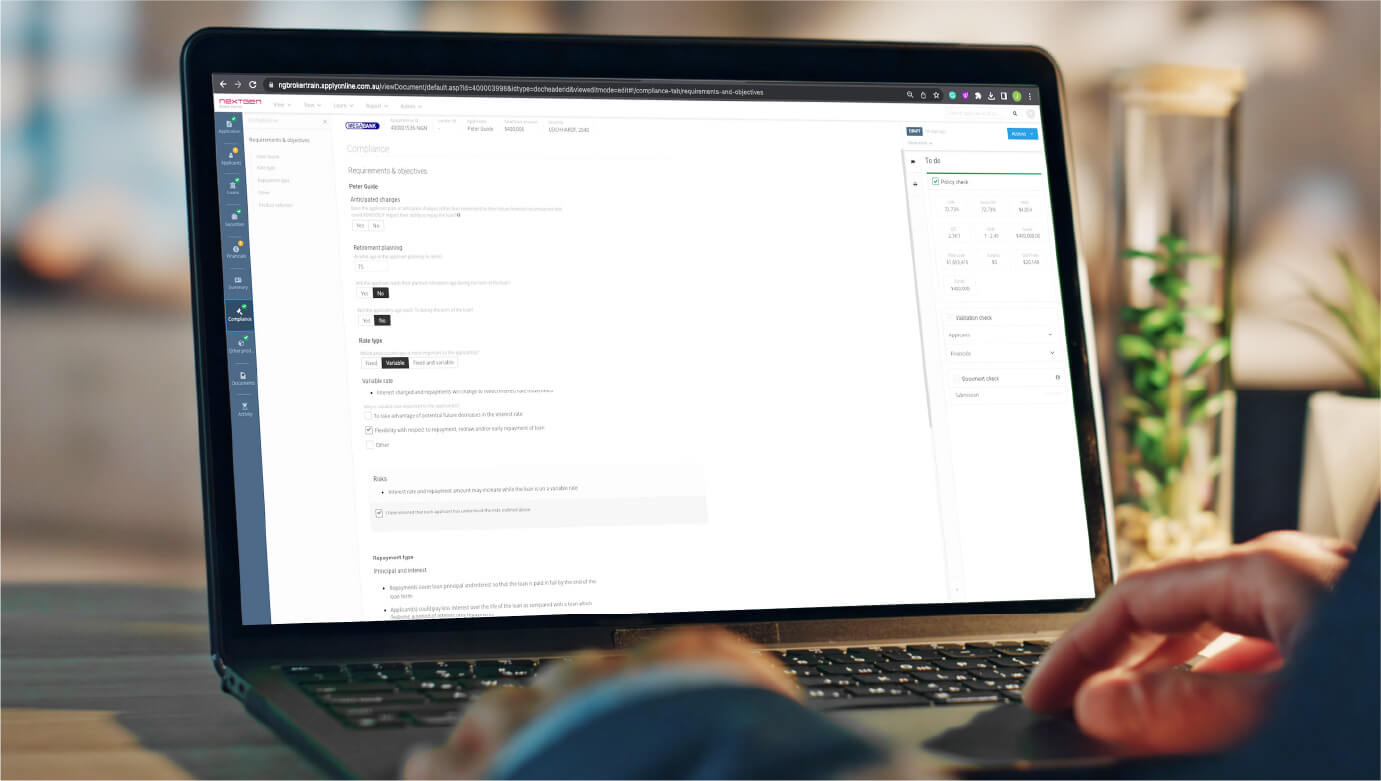

Responsible lending

Capture borrower objectives and validate responsible lending requirements for compliant loan writing and assessment.

Current and consistent responsible lending processes and controls ensure all requirements and objectives are systematically captured and assessed.

Smart questionnaires adapt to specific borrower responses and lending scenarios.

Simple and structured verification processes validate financial situation and suitability against borrower requirements and objectives.

Automatically validate supporting document authenticity and completeness through integrated verification tools and automated checks.

Enhance the lending process with integrated solutions that ensure accuracy, efficiency, and compliance.

Validate loan pricing and discounts instantly within applications, ensuring accuracy and clear upfront costs.

Integrate upfront property valuation requests for more accurate property details and precise loan calculations.

Automate lenders mortgage insurance premium estimates using mortgage application data prior to submission.

Track and manage all of your loan applications on the go with our mobile app.

Access verified credit and banking data to make confident lending decisions with accurate financial information.

Financial Passport

Streamline customer onboarding with secure biometric verification and government-backed document authentication.

Financial Passport

NextGen’s Financial Passport service securely accesses client banking data through Open Banking, fast-tracking loan applications with accurate information.

Financial Passport

Verify applicant financial data instantly through Equifax, eliminating errors and accelerating loan processing.

Discover how ApplyOnline can streamline applications for your lending products with seamless integrations and continual enhancements. Contact us today to learn more.

case study

Tim Lemon and Priya Hunur

National Sales Manager at MA Money and Chief Technology Officer at MA Financial Group

Settlement month record

SLA maintained consistently

Digital commercial submissions

Case study

Braden Bird and Jayne Kerford

Product & ESG Officer at RedZed and Chief Risk Officer at RedZed

Reduction in processing time

Digital submission rate achieved

Minutes per application processing

Case study

Nick May and Wendy den Hartog

Chief Customer Officer and Senior Manager for Lending Process and Optimisation at Beyond Bank Australia

Days faster end-to-end loan processing

Applications now use auto-decisioning

Point increase in NPS score

CASE STUDY

Shane Kuret and Rachel Morley

Chief Information Officer and Chief Growth and Experience Officer at BankVic

Reduced time to decision

Broker applications in first year of new market

Enhanced member experience and seamless operations across all lending channels

CASE STUDY

Karen Walsh

Head of Home Lending Product at Suncorp Bank

Increased broker NPS from -26

Time to Yes improved to number 1 in market

Largest increased in customer satisfaction

Article

Unlocking the ease of commercial distribution

Learn more

Media release

NextGen launches Open Banking-powered Automated Income Verification in ApplyOnline

Learn more

Media release

RedZed expands ApplyOnline partnership to include commercial and SMSF loan applications

Learn more

Article

The future of mutual banking: Insights from industry leaders

Learn more

Subscribe to our newsletter and never miss an update! Get the latest NextGen news and insights, ApplyOnline feature upgrades, and upcoming training webinar dates – all in one place.

Fill in your details below and we'll send the access link straight to your inbox.

We’ve sent your document download link to your email. Please check your inbox.